Environment

From Fossil Fuels to Green Futures: Oxford and EBC Financial Group on What’s Holding Us Back

Published

1 year agoon

EBC Financial Group and Oxford University’s Department of Economics dissect the barriers to climate progress, exploring carbon taxes, subsidy reforms, and the role of finance in driving sustainable economic growth globally

In a world increasingly shaped by the dual crises of climate change and economic instability, the Oxford Department of Economics, in collaboration with EBC Financial Group (EBC), hosted a pivotal session in the “What Economists Really Do?” (WERD) series. The event brought together leading minds from academia and finance to explore actionable strategies for aligning economic systems with environmental sustainability while addressing pressing societal concerns.

The event, titled “Macroeconomics and Climate,” featured a keynote lecture by Associate Professor Andrea Chiavari and a panel discussion titled “Sustaining Sustainability: Balancing Economic Growth and Climate Resilience,” moderated by Associate Professor Banu Demir Pakel. Panellists included Dr. Nicola Ranger, Director of the Global Finance Group of the Environmental Change Institute and Senior Research Fellow at Oxford, and David Barrett, CEO of EBC Financial Group (UK) Ltd. Together, they dissected the intersection of policy, finance, and human impact, offering practical insights and recommendations that extend beyond theoretical discourse.

From left to right: Dr. Nicola Ranger (Director of the Global Finance Group of the Environmental Change Institute and Senior Research Fellow), Associate Professor Andrea Chiavari (Department of Economics), David Barrett (CEO of EBC Financial Group (UK) Ltd), and Associate Professor Banu Demir Pakel (Department of Economics)

EBC Financial Group: Empowering Responsible Trading and Sustainable Innovation

EBC Financial Group, a growing presence in the global financial markets, connects clients worldwide to opportunities for trading in forex, commodities, indices, and more through its comprehensive brokerage solutions. Operating across major financial hubs and emerging markets, EBC equips traders with innovative tools and fosters collaboration to address the evolving challenges of global finance. As the official Foreign Exchange Partner of FC Barcelona and a partner of the United Nations’ United to Beat Malaria campaign, EBC is committed to shaping a future defined by sustainability, equity, and responsible trading practices.

EBC’s participation in WERD reflects the growing urgency of bridging financial markets and academic research to address climate and economic challenges. By contributing to a shared dialogue on actionable strategies, EBC joined a community of thought leaders in highlighting practical steps to align financial systems with sustainable development goals.

Can We Grow the Economy and Save the Planet?

At the core of the discussions was the recognition that financial and environmental security are universally shared concerns. Dr. Chiavari delivered an eye-opening keynote on the economic costs of climate change. He illustrated the dramatic growth of global GDP since the industrial revolution, juxtaposing this with the environmental toll of fossil fuel consumption and rising CO2 emissions. Chiavari highlighted the critical importance of the social cost of carbon in shaping effective policies.

Central to his message was the concept of the social cost of carbon, which quantifies the broader societal costs of emissions. “Carbon taxation is not just an environmental necessity but also an economic one,” he asserted. Dr. Chiavari explained how such measures could create the economic incentives needed to steer both corporations and individuals toward sustainable choices. “Well, think again yourself,” Chiavari added. “Turning on the radiator, your benefit is the same as before—having a warmer room. But now your cost is much higher than before.”

Expanding on this point, Dr. Chiavari emphasised that carbon taxation is designed to target carbon emissions rather than energy consumption itself. “Carbon taxation taxes carbon, it doesn’t tax energy,” he explained. “So it creates huge incentives for the private sector, for people, for you, for us, for me, to move from fossil fuels to alternative sources of energy. It’s not just about reducing energy or output; it creates huge incentives to switch towards alternative energy sources.”

Building on this foundation, the panel discussion delved deeper into the practicalities of aligning economic growth with climate resilience, moderated by Dr. Banu Demir Pakel.

Bridging Policy, Finance, and Action Through a Panel of Perspectives

The panel discussion explored the complex interplay between economic growth and climate resilience. Each panellist brought distinct expertise to the conversation, offering fresh perspectives on how global systems can adapt to these twin imperatives.

Dr. Chiavari emphasised the global nature of addressing climate change, highlighting that emissions transcend borders and require a coordinated international response. He discussed the risks of carbon leakage, where stringent climate policies in one country could lead to emissions being displaced to regions with weaker regulations, ultimately undermining global progress. To mitigate this, Chiavari advocated for policies that foster international collaboration and innovation, ensuring that transitions to sustainable practices are both equitable and comprehensive.

Dr. Ranger highlighted the economic opportunities that can emerge from climate action, stating, “This is not just about costs, it’s about opportunities.” Articulating the potential to create jobs and stimulate economic growth while addressing climate risks, Dr. Ranger also stressed the importance of reshaping public narratives. She underscored that effective climate action can foster innovation and progress without imposing a significant financial burden. She also advocates for redirecting fossil fuel and other environmentally damaging subsidies, which globally amount to up to $7 trillion annually, towards green investments, such as renewable energy.

Leveraging his extensive experience in financial markets, Barrett emphasised the importance of aligning market incentives with sustainability goals. He shared a frank assessment of the sector’s challenges in embracing sustainability, underscoring the profit-driven nature of financial institutions: “The financial market is driven by the need to make money—whether that’s for its shareholders or investors.” Barrett highlighted the critical need for governments to create enforceable regulatory frameworks, noting that this alignment is essential to channel the sector’s influence towards meaningful climate action.

On the topic of Environmental, Social, and Governance (ESG) frameworks, Barrett expressed concern over their current implementation, noting, “ESG has become a tick-box exercise.” He called for stronger policies that ensure accountability and deliver measurable impact, rather than simply meeting superficial compliance standards.

During a discussion on climate “clubs”, Barrett highlighted the risks of fragmented global efforts. He cautioned, “For these initiatives to succeed, they need to include all major players. Otherwise, the emissions reductions achieved in some regions could be offset by increased emissions elsewhere.” This, he warned, could undermine the collective progress necessary to address climate challenges.

What Practical Steps Should Governments, Businesses, and Individuals Take to Build a Sustainable Economic Future That Feels Attainable and Secure for Everyone?

Separately, the moderator and panellists were interviewed to expand on this crucial question, providing diverse perspectives on the collaborative roles of governments, businesses, and individuals in addressing climate challenges.

The Role of Governments: Policies and Planning

Dr. Demir Pakel emphasised the importance of education and awareness in addressing climate change, particularly the role of governments in driving change. “The government’s role is to start with increasing awareness,” she explained, stressing the need for early education about the consequences of climate change. She highlighted the need for policies that not only incentivise the private sector but also guide consumer behaviour, noting, “It’s a complex network where governments hold the primary responsibility for planning and guiding action at every level.”

“The private sector needs incentives to be able to take action because they will definitely look shorter-term compared to the government. Therefore, their behaviour needs to be changed, and the government has another role: implementing policies to change the behaviour of both the private sector and consumers,” she added.

Market Incentives and Carbon Taxation

Dr. Chiavari reinforced the need for government-led interventions, particularly through carbon taxation, as a means to correct market failures. He explained that by incorporating the societal cost of emissions into energy prices, governments can encourage more responsible consumption and investment decisions.

Changing the Narrative: A Positive Transition

Dr. Ranger reflected on the current challenges in climate action, echoing that a significant part of the problem lies in awareness. “At the moment, something is going wrong, and I think a lot of that is about the awareness side,” she noted. “Governments play a role, but the government fundamentally does what the public will vote for. And a lack of awareness of the immediate benefits of a green energy transition—for energy security and public health—is a key problem at the moment.”

Ranger criticised that the narrative surrounding climate change has failed in recent years by framing it as a costly and burdensome challenge. “Particularly the narrative is this is going to cost a lot of money to deal with. I don’t agree with that view and it is not supported by the evidence. You know, we have to make hard decisions, but what we know is that right now the way we are approaching this is making it harder—specifically, a lack of certainty from government on its policies stalls investment and increases the costs. All the evidence shows that if we get the right policies in place and set a clear path for investors, a just transition is both the lowest cost and more beneficial pathway,” she said.

Pointing to fossil fuel subsidies, she highlighted how their redirection could catalyse a positive transition. “Globally, we pump so much money into fossil fuel subsidies—estimates range from five to seven trillion dollars a year. If you stopped that and put it into clean technologies, we would have solved the problem.”

To address this, Ranger called for a shift in public discourse to emphasise the economic opportunities inherent in climate action. She stressed the role of academics and experts in reshaping the narrative, saying, “We need to make sure people understand this is a positive transition. Through good government policy, the impact on individuals will not be significant and would actually boost job growth and innovation.”

Ranger concluded by urging governments to take the lead in changing this narrative, saying, “What I’d really like to see is governments getting behind this and saying, ‘Look, this is what’s going to happen. It’s going to benefit you. Here is the pathway. This is what both investors and the public need.’”

The Role of Businesses and Individuals: Accountability and Innovation

Barrett provided a candid perspective on the role of businesses and individuals in climate action. He highlighted the financial sector’s profit-driven nature, cautioning that it would not lead sustainability efforts without clear regulatory frameworks. “Financial markets will not do it on their own. They need to be incentivised to act,” he stated. “Once the financial sector is pointed in a direction and gets enthusiastic about a topic, it can accomplish incredible things, but it requires clear policy and incentives to get there.”

Barrett also reflected on the role of individuals as voters and consumers, stressing that their choices can significantly influence policy and corporate behaviour. “Policy needs to be much better at educating the voter about what it wants and how it should expect that to come about,” he remarked. By prioritising sustainable practices and holding policymakers accountable, individuals can drive systemic change.

While critical of superficial measures such as “tick-box” ESG frameworks, Barrett maintained an optimistic outlook on the potential of finance. “Finance can be incredibly innovative,” he noted. “It can move mountains and solve real problems, but it needs the right incentives and honest conversations about what’s at stake.” He called for a shift from short-term political cycles to forward-looking strategies, urging all stakeholders to embrace the long-term effort required to address the climate crisis effectively.

To watch the full session of WERD’s “Macroeconomics and Climate” episode, including the keynote and panel discussion, please visit https://youtu.be/MD5vaMjQdkc.

You may like

-

Flipkart appoints Digbijay Mishra as new VP of Corporate Communications

-

Heavy hitting England face-off with India in Mumbai Semifinal

-

Fans roast Karan Aujla’s Mumbai concert

-

India’s Logistics Ambition on Full Display at Transport Logistic India and Air Cargo India 2026

-

Report: Mojtaba Khamenei named new Supreme Leader of Iran

-

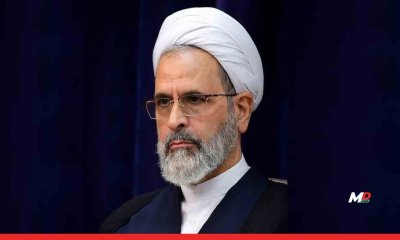

Who is Ayatollah Alireza Arafi, Iran’s interim Supreme leader?