Business

Silicon Valley Bank shutdown- the biggest bank failure since global financial crisis

Published

1 year agoon

The fall of Silicon Valley Bank (SVB) has been the talk of the town ever since the bank’s 40-year reign came to an end amid liquidity concerns brought on by a bank run made by the very venture capital community that SVB had supported and served. The emblematic bank of the tech industry was shut down by regulators and seized its deposits, making it the second-biggest bank failure in US history, after Washington Mutual in 2008.

After shocking investors with the revelation that it needed to raise $2.25 billion to strengthen its balance sheet, the company’s downhill spiral began. What came next was the swift demise of a reputed bank that had developed deep inroads with its tech clientele.

Silicon Valley Bank’s beginnings

Founded in 1983 after a poker game, SVB was an important engine for the tech industry’s success and the 16th largest bank in the US before its collapse. Even as innovators are idolised in the tech sector, it’s easy to forget that money is what fuels business.

SVB provided that fuel, collaborating closely with numerous firms backed by VC funding. It made the claim that it was the “go-to bank for investors” and the “financial partner of the innovation economy.” The company that owns this website is one of the clients of SVB. Not only that; more than 2,500 VC firms and numerous tech executives banked there.

In less than 48 hours, it collapsed like a house of cards.

The problem at SVB really started with its wild success. Many of its tech company customers were raking in money during the early pandemic. Its deposit base tripled between 2020 and 2022, with billions and billions of dollars flowing in.

A lot of those billions had come from all of the risks the bank took, lending money to start-ups and companies that couldn’t get loans at other banks. Those risks paid off. And Silicon Valley Bank took all of the billions it earned from taking those risks and stowed them into what is supposed to be the least risky investment around; US government bonds.

Seeking higher investment returns, in late 2021, SVB made a decision that had a profound impact. As the Federal Reserve increased interest rates to tame an inflation rise, the market value of these bonds fell dramatically through 2022 and into 2023, resulting in unrealized losses on the portfolio.

SVB ran out of money as startup clients withdrew deposits to keep their businesses afloat in a frigid environment for IPOs and private fundraising. To raise cash to pay withdrawals by its depositors, SVB announced on March 8 that it had sold over US$21 billion worth of securities, borrowed $15 billion, and would hold an emergency sale of some of its treasury stock to raise $2.25 billion.

The sudden need for fresh capital, coming on the heels of the collapse of crypto-focused Silvergate bank, sparked another wave of deposit withdrawals as VCs instructed their portfolio companies to move funds, according to people with knowledge of the matter.

SVB was seized by the California Department of Financial Protection and Innovation early on March 10, 2023, and placed under the Federal Deposit Insurance Corporation’s receivership (FDIC). The bank’s $172 billion in deposit liabilities were over the FDIC’s maximum insurance limit by over 89%.

Customers of SVB stated that CEO Greg Becker’s advice to “remain cool” during a Thursday afternoon call didn’t instill trust in them. The stock’s collapse continued unabated, and the bank was bleeding by the end of regular trading. All told, customers withdrew a staggering $42 billion of deposits by the end of the day, according to a California regulatory filing. By the close of business that day, SVB had a negative cash balance of $958 million, according to the filing, and failed to scrounge enough collateral from other sources, the regulator said.

Ryan Falvey, a former SVB employee who launched his own fund in 2018, pointed to the highly interconnected nature of the tech investing community as a key reason for the bank’s sudden demise.

Prominent funds including Union Square Ventures and Coatue Management blasted emails to their entire rosters of startups in recent days, instructing them to pull funds out of SVB on concerns of a bank run.

What happens to Silicon Valley Bank’s customers?

Most banks are insured by the Federal Deposit Insurance Corporation (FDIC), a government agency that’s been around since the Great Depression. Fortunately, the FDIC insured the accounts of SVB, but only up to $250,000.

The FDIC said uninsured depositors will get receivership certificates for their balances. The regulator said it will pay uninsured depositors an advanced dividend within the next week, with potential additional dividend payments as the regulator sells SVB’s assets.

Whether depositors with more than $250,000 ultimately get all their money back will be determined by the amount of money the regulator gets as it sells SVB assets or if another bank takes ownership of the remaining assets. There were concerns in the tech community that until that process unfolds, some companies may have issues making payroll.

So if SVB doesn’t exist anymore, what takes its place?

The collapse of SVB leaves companies and wealthy individuals largely unsure of what will happen to their money.

In response to the collapse, the FDIC created a new entity, the Deposit Insurance National Bank of Santa Clara, for all insured deposits for SVB. People who have uninsured deposits will be paid an advanced dividend and get a little certificate, but that isn’t a guarantee people will get all their money back.

The FDIC’s job is to get the maximum amount from SVB’s assets. That can happen in a couple of ways. One is that another bank acquires SVB, getting the deposits in the process. In the best-case scenario, that acquisition means that everyone gets all their money back. Doing so will also help the FDIC achieve its greater objectives, which is to ensure stability and public confidence in the US banking system. But what if the acquisition doesn’t take place? In that scenario, the FDIC examines and then sells the assets connected to SVB over the course of a few weeks or months, with the money going to the depositors. Only administrative costs and insured deposits rate higher on the pay-back scale than uninsured deposits. Hence, even if a sale doesn’t occur quickly, it’s likely that buyers will still receive their money back, if they can make ends meet while they wait.

You may like

-

Paris 2024 Olympics: 5 of the most stylish uniforms on show

-

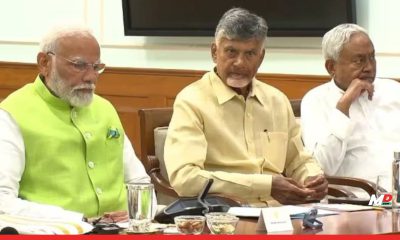

FM showers special love on Bihar and Andhra Pradesh in Budget 2024, as Opposition leaders cry “Kursi Bachao”

-

DreameIndia Appoints Manu Sharma as Managing Director to lead its India Operations and Market Expansion

-

Amazon eyes Swiggy Instamart to boost Quick Commerce in India

-

Economic Survey urges creation of 78.51 Lakh non-farm jobs annually

-

Explained: The significance of Savan in India