Politics

Tariff pe Tariff: Is the India-US Partnership at a Crossroads?

Published

7 months agoon

For the past quarter-century, US-India relations have been one of the defining stories of 21st-century geopolitics. From Cold War wariness, the relationship matured into a robust strategic and economic partnership, tied by mutual democratic values, Indo-Pacific alignment, and a surging trade and technology corridor.

By 2025, the United States stands as India’s single largest export market, with two-way trade exceeding $130 billion annually and ambitions set even higher. But as of August 2025, this carefully nurtured partnership faces its most severe challenge: a sudden tariff war that exposes the fragility beneath years of strategic convergence.

Trump’s Tariffs Trigger Shock and Disbelief

On July 30, 2025, President Donald Trump announced a blanket 25% tariff on all Indian imports—without exemptions—effective August 1. This move, coupled with a still-undefined “penalty” for India’s energy and defense deals with Russia, marks a dramatic escalation in US-India trade diplomacy.

These new tariffs put India at a steeper disadvantage compared not only to the European Union (who face 15% tariffs) but also to Vietnam, Indonesia, Japan, and South Korea. The White House justified the action by citing the rising $45.7 billion trade deficit, India’s “excessive” tariffs on US goods, restrictive non-tariff barriers, and, most directly, India’s surging oil imports from Russia.

Why Russian Oil Became the Flashpoint

The realpolitik of oil lies at the heart of this dispute. Since the onset of the Ukraine war, India has shifted nearly 40% of its crude imports to discounted Russian barrels. This allowed Delhi to cushion inflation and maintain growth, even as US and European policymakers viewed these purchases as a lifeline for Moscow’s war machine. Trump’s public statements have accused India of both “profiting from Russian oil” and reselling it abroad.

Yet, ironically, US officials previously encouraged such purchases to stabilize global markets—including American suppliers who have seen their own exports to India soar over 50% in 2025. There is, perhaps, a deeper calculus at play. That of protecting of US oil lobbies and the strategic redirecting of India’s energy dependence away from Moscow and toward Washington-aligned flows.

India’s Response: National Interests and Global Fairness

Delhi’s reaction has been forceful yet measured. Government spokespeople have lambasted the tariffs as “unjustified and unreasonable,” emphasizing India’s sovereign right to seek affordable energy and asserting that Western markets themselves still buy from Russia, albeit through indirect flows. External Affairs Minister S. Jaishankar highlighted Delhi’s desire for a “fair global order, not dominated by a few.”

Privately, Indian officials stress that while bilateral trade talks remain on the table, they will not accept forced reduction in Russian oil imports that would increase India’s energy bill by an estimated $11 billion annually and risk inflation and job losses at home.

Economic Shockwaves and Ripple Effects

The imposition of the 25% US tariff on Indian goods is expected to have a broad and notable impact across various sectors of the Indian economy.

Key export sectors such as pharmaceuticals, which supply about half of the United States’ generic drug market, textiles and garments, electronics (including significant production of iPhones and IT hardware), gems and jewelry, and auto components all face a serious pricing disadvantage in their largest export market.

This disadvantage not only threatens the competitiveness of Indian exporters but also risks diverting orders to countries like Vietnam, Indonesia, and Thailand, which face lower tariffs. Economists estimate that the new tariffs may cause an $18 billion annual decline in exports, potentially cutting up to 0.25% from India’s GDP growth. Small and medium enterprises, which operate on small margins and limited working capital, are particularly vulnerable to these tariff hikes and could face job losses as they struggle to absorb increased costs or find alternate markets.

The ripple effects in capital markets have already been seen, with a dip in Indian equity prices and downward revisions by rating agencies. Nonetheless, despite the external challenges, India’s economic fundamentals show resilience, supported by strong domestic demand and fiscal prudence. However, global uncertainty and trade tensions represent downside risks to India’s growth trajectory in the near term.

The Geopolitical Gambit: Strategic Risks and Opportunities in the Offing

The tariff confrontation between India and the US reveals deeper strategic contestations beyond trade balances. The Trump administration’s “America First” approach views tariffs as critical leverage to address perceived unfair trade practices and to realign India’s strategic posture away from Russia.

These tariffs serve as a tool to exert pressure on India to reduce its energy and defense reliance on Moscow amid the broader Russia-China-West geopolitical rivalry. From India’s side, the tariffs represent a challenge to its strategic autonomy. While India remains committed to ongoing trade discussions, it is simultaneously advancing efforts to diversify partnerships with other global players, including the European Union, ASEAN countries, and the Middle East. This diversification aims to reduce reliance on the United States and build domestic industrial resilience through initiatives like Make in India and production-linked incentive schemes.

This entire kerfuffle also risks straining defense and security cooperation, an area of increasing importance to both nations. The resultant tension illustrates the difficulty of balancing national interests, economic imperatives, and global strategic alignments in an era of complex multi-polar geopolitics. Both India and the US face a precarious road ahead, navigating whether to reconcile differences for mutual benefit or risk a protracted rupture with consequences for the wider Indo-Pacific order.

Protracted Negotiations or a Drawn-out Decoupling?

Despite the hard rhetoric, both sides know a total decoupling would be mutually damaging and geopolitically destabilizing. Indian negotiators continue to propose phased movement on market access, agricultural imports, and digital trade rules. The US, for its part, offers the (diminishing) carrot of a comprehensive bilateral trade deal if Delhi makes major concessions.

But the current tariff war sets a dangerous precedent, demonstrating the limits of minilateral agreements and “friend-shoring” strategies. Other emerging market economies—Brazil, Indonesia, Vietnam—are watching closely to see whether India’s strategic and economic clout allows it to weather protectionist storms or if their own deals with Washington become more attractive.

The Price of Power and Interdependence

The 2025 India-US tariff kerfuffle is not a transient spat but rather a pivotal stress test for the new world order. It exposes the inherent tension between economic interdependence and strategic autonomy, highlighting how quickly “decades of trust” can unravel when populist policies, energy shocks, and great-power rivalry collide.

Both Washington and New Delhi must decide, in the coming months, whether the pursuit of short-term leverage is worth the risk of enduring rupture. For the broader global South, the outcome may shape not only the trajectory of India-US ties, but also the very architecture of international trade and strategic alignments for years to come.

You may like

-

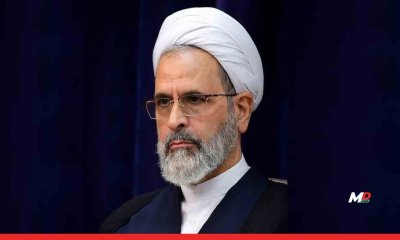

Who is Ayatollah Alireza Arafi, Iran’s interim Supreme leader?

-

What is ‘Temple’, Deepinder Goyal’s new Brain Wearable?

-

Escalating Israel-US-Iran conflict sees aviation network grounded

-

What does the Paramount-Warner Bros deal mean for the future of streaming

-

Renault India February Sales Jump 31%, Growth Streak Continues ahead of Duster Launch

-

Ayatollah Khamenei confirmed killed, as Tehran promises retribution