Politics

How Will the US Presidential Elections Affect India?

Published

1 year agoon

The US Presidential elections are not just a local affair; they have the potential to send ripples across the globe, particularly affecting countries like India. With the world’s largest economy and a significant military presence, the policies and strategies adopted by the United States can influence a myriad of sectors, including trade, defense, and foreign relations. As the 2024 elections loom large, the stakes are high for both the candidates and the countries that look to the US for leadership.

Understanding What’s at Stake

The stakes of the US Presidential elections extend far beyond American borders. As the elections are now upon us, the uncertainty surrounding the outcome creates a buzz in global markets. The potential for policy shifts can lead to speculation and volatility, affecting investors and businesses in India.

Economic Implications

The US is a critical trading partner for India, with a substantial flow of goods and services between the two nations. The outcome of the elections will likely influence trade agreements, tariffs, and investment flows.

- Trade Relations: The direction of trade policies under either candidate could have a profound effect on Indian exports, particularly in sectors like IT, pharmaceuticals, and textiles.

- Investment Climate: The US is a leading investor in India, especially in technology and renewable energy. Changes in US policy could either enhance or hinder foreign direct investment.

Geopolitical Landscape

The US plays a pivotal role in global politics, and its stance on issues such as defense and alliances can significantly affect India’s strategic positioning.

- Defense Ties: The nature of US-India defense relations may shift depending on the election outcome, impacting joint military exercises and arms deals.

- Regional Stability: The US’s approach to countries like China and Pakistan will influence India’s security dynamics.

The Candidates: Trump vs. Harris

As we gear up for the elections, the two leading candidates—Donald Trump and Kamala Harris—present contrasting visions for America and its role in the world.

Donald Trump’s Policies

Trump’s administration is characterized by a focus on “America First,” which translates to a more isolationist approach in some areas while being aggressive in others.

- Trade Policies: Trump has been vocal about imposing tariffs on imports, particularly from China. This could lead to increased costs for Indian goods entering the US market.

- Economic Strategy: His inclination to lower corporate taxes and deregulate industries may create a favorable environment for US businesses but could also lead to inflationary pressures.

Kamala Harris’s Approach

Harris represents a more traditional Democratic stance, emphasizing cooperation and multilateralism.

- Taxation and Spending: She has indicated plans to increase taxes on corporations and high earners, which could affect US economic growth but may stabilize markets in the long run.

- Foreign Policy: Harris’s approach is likely to maintain the status quo regarding international alliances, which may benefit India through continued support in defense and trade.

Impact on India’s Economy

The economic impact of the US elections on India cannot be overstated. Depending on which candidate emerges victorious, various sectors may experience different levels of growth or decline.

- IT and Services: The Indian IT sector, which thrives on exports to the US, could face challenges if protectionist policies are enacted.

- Pharmaceuticals: Changes in tariffs could impact the pharmaceutical sector, particularly generic drug exports, which are vital for India’s economy.

Foreign Direct Investment (FDI)

US investments in India have been a significant driver of growth, particularly in technology and infrastructure.

- Investment Trends: A Trump victory may lead to a more aggressive stance on foreign investments, while a Harris win could encourage a more stable investment climate.

- Sectoral Focus: Sectors like renewable energy and technology may see increased interest depending on the candidate’s policies.

Sectoral Analysis: Winners and Losers

The elections will have varying implications across different sectors in India. Understanding which industries might benefit or suffer can help investors and businesses strategize accordingly.

Commodities and Natural Resources

Commodity markets are often sensitive to changes in US economic policies, particularly those related to fiscal expansion and inflation.

- Oil and Gas: A Trump administration may favor deregulation in the energy sector, benefiting traditional energy companies.

- Renewable Energy: Conversely, a Harris administration is likely to prioritize renewable energy initiatives, which could boost sectors related to solar and wind energy.

Healthcare Sector

The healthcare industry in India is poised to face challenges and opportunities depending on the election outcome.

- Pharmaceutical Exports: Changes in US healthcare policies may directly impact India’s pharmaceutical exports, particularly in the generic drug market.

- Healthcare Investments: A focus on healthcare reform in the US could lead to increased investments in the Indian healthcare sector.

Geopolitical Ramifications

The geopolitical landscape will also shift based on the election results, impacting India’s strategic alliances and defense posture.

US-China Relations

The US’s approach to China is crucial for India, given the ongoing tensions in the region.

- Trade Wars: A Trump administration may escalate trade tensions with China, potentially benefiting India as companies seek alternative manufacturing bases.

- Strategic Alliances: A Harris administration may pursue a more collaborative approach, impacting India’s defense strategy and alliances in the Indo-Pacific.

Regional Security

The US’s stance on regional issues will influence India’s security dynamics, particularly concerning Pakistan and China.

- Defense Cooperation: Continued support for India from the US could bolster defense ties, enhancing India’s capabilities against regional threats.

- Counter-Terrorism Efforts: A focus on counter-terrorism could lead to increased collaboration between the US and India.

Investor Sentiment and Market Reactions

The elections will undoubtedly influence investor sentiment and market dynamics in India.

Stock Market Volatility

The stock market often reacts to political uncertainty, and the upcoming elections are no exception.

- Market Speculation: Investors may adopt a wait-and-see approach, leading to increased volatility in the short term.

- Long-Term Outlook: Depending on the election outcome, sectors may experience significant shifts, creating both risks and opportunities for investors.

FPI Flows

Foreign Portfolio Investment (FPI) is crucial for India’s financial markets, and the election results could impact these flows.

- Interest Rates: Delays in US interest rate cuts could affect FPI flows into India, impacting liquidity in the markets.

- Market Confidence: A stable political environment post-elections may restore investor confidence and encourage FPI inflows.

Recommendations for Indian Investors

With the elections looming, Indian investors should consider strategic approaches to navigate potential market changes.

Diversification Strategies

A diversified investment portfolio can help mitigate risks associated with political uncertainty.

- Sector Allocation: Investors should focus on sectors that are likely to benefit from the election outcome, such as technology and renewable energy.

- Geographic Diversification: Expanding investments beyond India can help reduce exposure to domestic market volatility.

Monitoring Policy Changes

Staying informed about the candidates’ policies and their potential implications is crucial for making informed investment decisions.

- Economic Indicators: Keeping an eye on economic indicators in the US can provide insights into future market trends.

- Global Developments: Understanding the broader geopolitical landscape will help investors anticipate shifts in market dynamics.

Looking to the Future

As the US presidential elections approach, the implications for India are multifaceted and complex. The outcome will undoubtedly shape trade relationships, economic growth, and geopolitical dynamics. Whether it’s the aggressive policies of Trump or the more collaborative approach of Harris, India must navigate these changes strategically.

Investors, businesses, and policymakers should remain vigilant, adapting to the evolving landscape while capitalizing on opportunities that arise. In this high-stakes game of politics, the only certainty is uncertainty—so buckle up, keep your eyes on the news, and be ready to pivot as the political winds shift.

You may like

-

Flipkart appoints Digbijay Mishra as new VP of Corporate Communications

-

Heavy hitting England face-off with India in Mumbai Semifinal

-

Fans roast Karan Aujla’s Mumbai concert

-

India’s Logistics Ambition on Full Display at Transport Logistic India and Air Cargo India 2026

-

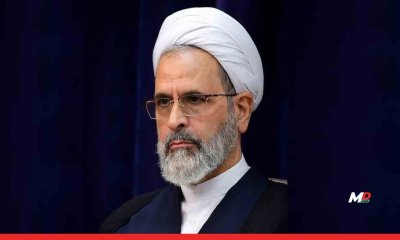

Report: Mojtaba Khamenei named new Supreme Leader of Iran

-

Who is Ayatollah Alireza Arafi, Iran’s interim Supreme leader?