Business

Why Do We Celebrate Loss-Making Founders? The Kunal Shah Debate and India’s Startup Reckoning

Published

8 months agoon

When Deloitte Senior Consultant Adarsh Samalopanan questioned on LinkedIn why India celebrates Kunal Shah despite his companies recording no profit in 15 years, it struck a chord that reverberated far beyond Shah himself. The question was stark: “Fifteen years into entrepreneurship, he has yet to record a single profitable financial year – so remind me again why we celebrate him?”

The post triggered a flurry of reactions. Some hailed Shah’s ability to build platforms that reshaped consumer behaviour, while others decried what they see as the celebration of inflated valuations over sustainable business models. Shah himself responded with characteristic candour.

“Absolutely correct,” he wrote, acknowledging that profitability matters, before adding: “We should be celebrating thousands of entrepreneurs who have created very profitable companies without external capital. We should celebrate everyone who is taking risk in life and being an entrepreneur cause in post-AI world being job seeker is going to be more risky. We need more job creators.”

This exchange laid bare a critical tension at the heart of India’s startup ecosystem. Are founders celebrated for creating truly valuable, sustainable businesses, or merely for raising vast sums and chasing valuation highs that eventually crash back to earth?

The Story of Freecharge and Cred

Shah co-founded Freecharge in 2010, at a time when digital payments were still novel in India. By 2015, it had earned Rs 35 crore in revenue but incurred losses of Rs 269 crore. Snapdeal’s acquisition of Freecharge for Rs 2,800 crore seemed a success story then – until it ran out of steam, and Axis Bank bought it for just Rs 370 crore two years later.

His current venture, Cred, launched in 2018, seeks to make credit card bill payments rewarding. It is one of India’s most talked-about fintech startups, with a sleek user interface and aspirational brand positioning. Yet, its finances tell a stark story: cumulative revenue of Rs 493 crore over seven years against net losses totalling Rs 5,215 crore. Its valuation, which peaked at $6.4 billion in 2022, has fallen by nearly 45% to about $3.5 billion.

The Broader Startup Challenge: Growth Over Profit

Cred is far from alone. Over the past two years, Indian startups have seen a wave of valuation markdowns as global capital becomes more cautious. Meesho, Oyo, Swiggy, Flipkart, and others have all seen valuations decline sharply, even as funding soars. According to Tracxn data, at least 55 companies across fintech, SaaS, and consumer internet sectors have experienced valuation declines since early 2023.

The reasons are rooted in a decade-long culture of chasing growth at any cost. India’s vast young population, rapidly digitising economy, and eager venture capital funds created a perfect storm. Startups prioritised scaling up rapidly, acquiring users with steep discounts, and burning through cash reserves to dominate markets. For a while, it worked. The narrative of the unstoppable Indian unicorn was born.

But as the free-flowing capital of the pandemic years dried up, fundamentals reasserted themselves. Mohan Kumar of Avataar Venture Partners noted that SaaS companies once commanding 30-100x revenue multiples have reverted to historical norms of around 7-10x. “The pandemic era was an aberration where free capital distorted pricing,” he said.

Why Profitability Remains Elusive

The dilemma facing Indian startups is structural. First, the intense competition drives up customer acquisition costs. For e-commerce and fintech platforms, discounts and rewards are powerful lures, but they eat away margins. Second, operational efficiency often lags rapid growth. Hiring sprees, expansive marketing budgets, and tech investments quickly balloon costs without immediate payoffs.

Third, scalability remains a hurdle. Infrastructure limitations, regulatory complexities, and a still-evolving consumer credit market constrain expansion. Even with a strong vision, as in Shah’s case, building a profitable model is challenging when user monetisation remains low and loyalty is tied to incentives.

Should We Still Celebrate Founders Like Shah?

This is where the debate polarises. Critics argue that celebrating founders whose businesses remain loss-making sets a dangerous precedent, prioritising hype over prudence. They point to Freecharge’s journey as emblematic – a once-high-flying venture sold at a fraction of its earlier valuation.

Supporters, however, see the matter differently. They argue that Shah’s ventures fundamentally changed consumer behaviour in India. Freecharge made digital payments mainstream before UPI’s dominance. Cred transformed credit card payments into a premium, gamified experience, educating users on timely bill payments and financial discipline. As one LinkedIn user wrote: “Companies like Amazon and Uber bled money for years before turning profitable – his ventures might follow a similar arc.”

Bhanu Pratap Singh, CEO of Cashcry, summed it up: “Kunal Shah has built platforms that moved India’s digital payments and credit culture forward. He’s generated wealth for investors, created jobs, and inspired an entire generation to dare bigger.”

India’s Startup Valuation Reset

The recent valuation markdowns are not necessarily reflections of business failure. Rather, they mark a recalibration from frothy pandemic-era highs to more realistic assessments. As investors demand clearer paths to profitability, startups are pivoting from reckless expansion to building sustainable revenue models.

This reset, though painful, could be healthy. It forces founders to shift focus from vanity metrics to financial fundamentals. Innovation remains crucial, but only if it is anchored in a model that eventually generates profits, not just attention.

The Path Ahead: Building Real Value

For Indian startups, the way forward lies in combining ambition with grounded execution. That means:

- Prioritising core offerings over diversifying prematurely.

- Managing cash flows meticulously to avoid dependency on constant funding rounds.

- Enhancing operational efficiency to support scale sustainably.

- Diversifying revenue streams to weather market shifts.

- Using technology strategically to optimise costs and improve customer experience.

As AI and automation reshape the global job market, Shah’s argument that entrepreneurship creates job creators, not seekers, carries weight. But for entrepreneurship to truly transform India, it must create not only jobs but also enduring value. Sustainable business models, profitability, and ethical scaling must underpin the next chapter.

Beyond the Founder Debate

Ultimately, the Kunal Shah debate is a mirror reflecting deeper truths about India’s startup ecosystem. It reveals a culture at crossroads: one foot in the world of audacious innovation, the other trapped in vanity metrics. The challenge now is to bring these feet together on firm ground.

Valuation highs may earn headlines, but only profitability builds legacies. For India’s startup dreams to mature, founders will need to be celebrated not just for daring to dream, but for executing dreams that endure the test of time and value.

You may like

-

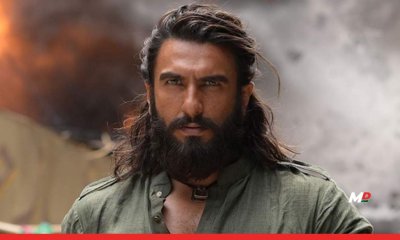

5 major takeaways from the trailer of Dhurandhar 2

-

What is the “Value Creation Zone”, and how can you make it work for you?

-

Ranveer Singh’s Dhurandhar 2 breaks records with 2 lakh+ preview tickets sold

-

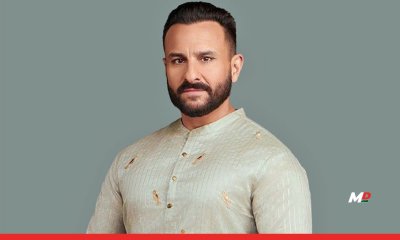

Saif Ali Khan weighs in on Bollywood’s pay gap

-

From the mic to the mountain throne, Nepal’s Rapper-Turned-Leader Reshapes a Nation

-

Shah Rukh Khan, Virat-Anushka, Akshay Kumar, and more celebrate as India lifts the T20 World Cup