Published

2 years agoon

In a historic feat, Nvidia, the heavyweight chipmaker, witnessed a staggering increase of $277 billion in stock market value in a single day. This unprecedented surge was driven by the company’s quarterly report, which showcased remarkable growth in demand for its specialized chips used in Artificial Intelligence (AI) computing.

As a result, Nvidia’s stock price soared by 16.4%, closing at a record-high of $785.38. With a market capitalisation of $1.96 trillion, Nvidia solidified its position as the third most valuable company in the U.S. stock market, surpassing tech giants like Amazon and Alphabet.

To put that in perspective, Nvidia’s latest jump in share price now gives it a market capitalisation that now surpasses the size of the Canadian economy (valued at C$2.349 trillion, or the equivalent of $1.74 trillion, as of 3Q).

Nvidia, headquartered in Santa Clara, California, has established itself as a key player in the AI revolution. The company’s chips, known for their exceptional performance in AI computing, have garnered immense popularity among businesses striving to enhance their AI capabilities. As a result, Nvidia reported a staggering growth of 233% in current-quarter revenue, surpassing market expectations of a 208% rise. This surge in demand for Nvidia’s chips has not only propelled the company’s market value to unprecedented heights but also catalysed a global rally in technology stocks associated with AI.

Nvidia’s success can be attributed to its dominance in the high-end AI chip market. The company controls approximately 80% of this market segment, solidifying its position as a leader in AI computing. As businesses worldwide rush to upgrade their AI offerings, the demand for Nvidia’s chips has skyrocketed. This surge in demand not only fueled Nvidia’s remarkable performance but also benefited other chipmakers exposed to AI. For instance, Advanced Micro Devices witnessed an 11% jump in its stock price, while Broadcom experienced a 6.3% increase. The Philadelphia chip index also rallied, reaching a record high with its biggest one-day gain since May 2023.

Nvidia’s astounding increase in stock market value has had a significant impact on the overall stock market. The S&P 500 surged by 2.11%, reaching a record high, while the Nasdaq jumped nearly 3%, coming close to its first record-high close since November 2021. This rally in technology stocks linked to AI propelled indices like Europe’s STOXX 600 and Japan’s share average to record highs as well. The surge in Nvidia’s market value on this historic day even surpassed the entire value of companies like Coca-Cola, which stands at $265 billion.

To understand the significance of Nvidia’s role in the tech revolution, one can draw parallels with the gold rush of the mid-1800s. Just as those who provided the tools to extract gold profited the most, Nvidia is playing a similar role in today’s tech revolution. By offering specialized chips for AI computing, Nvidia has positioned itself as an essential enabler for businesses seeking to harness the power of AI. As a result, the company has witnessed a meteoric rise in its stock value. Russ Mould, investment director at AJ Bell, aptly states, “Nvidia is effectively playing the same role today in this tech revolution.”

While Nvidia’s success story is awe-inspiring, there are concerns about the rapid pace of its gains. The company’s stock has climbed 58% in 2024, contributing significantly to the overall increase of the S&P 500. Such a level of growth has raised questions about whether the market has already priced in Nvidia’s future success. Additionally, there are concerns about the potential impact of U.S. curbs on chip sales in China. Nvidia’s sales in China accounted for about 9% of its fourth-quarter sales, a significant decrease from the previous quarter’s 22%. This decline raises questions about the company’s future growth trajectory.

Analysts have responded positively to Nvidia’s quarterly report, with several brokerages raising their price targets. Rosenblatt Securities, one of the most bullish, increased its price target to $1,400 from $1,100, implying a staggering $3.5 trillion stock market value. However, there are differing opinions, as UBS lowered its price target to $800 from $850, reflecting concerns about potential slowing in revenue growth. The sentiment among investors is mixed, with some worried about the rapid pace of Nvidia’s gains and others confident in the company’s future prospects.

Nvidia’s remarkable success not only affects direct shareholders but also has broader implications for retirement savings accounts and index funds. As a significant contributor to the S&P 500’s increase, Nvidia’s performance directly impacts the returns of index funds widely held in retirement savings accounts. Therefore, the outlook for Nvidia’s future growth becomes crucial for both direct shareholders and investors with diversified portfolios.

Nvidia’s success story goes beyond financial gains. The company’s expertise in AI computing and its dominance in the high-end AI chip market position it as a key player in shaping the future. As businesses continue to explore the vast potential of AI, Nvidia’s specialized chips will play a vital role in enabling innovation and driving technological advancements. The company’s contribution to the tech revolution is invaluable and will continue to impact various industries, including healthcare, finance, transportation, and more.

Nvidia’s record-breaking increase in stock market value is a testament to the company’s exceptional performance and its pivotal role in the AI revolution. As demand for specialized AI chips skyrockets, Nvidia has capitalized on the opportunity and solidified its position as a leader in the high-end AI chip market. However, concerns about the company’s rapid growth and potential challenges lie ahead. The impact of U.S. curbs on chip sales in China and the market’s expectations for future growth present significant factors to consider. Regardless, Nvidia’s success story serves as an inspiration for companies seeking to provide essential tools in today’s tech revolution. As the world embraces AI, Nvidia will continue to shape the future and drive innovation across industries.

Flipkart appoints Digbijay Mishra as new VP of Corporate Communications

Heavy hitting England face-off with India in Mumbai Semifinal

Fans roast Karan Aujla’s Mumbai concert

India’s Logistics Ambition on Full Display at Transport Logistic India and Air Cargo India 2026

Report: Mojtaba Khamenei named new Supreme Leader of Iran

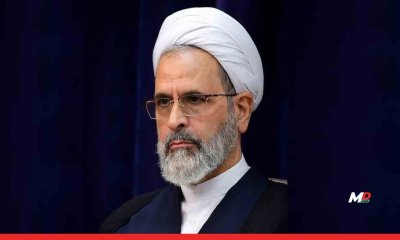

Who is Ayatollah Alireza Arafi, Iran’s interim Supreme leader?