Business

Global Supply Chain Shifts: India’s Moment to Shine?

Published

1 year agoon

The global manufacturing landscape is undergoing a profound transformation as companies worldwide reassess their supply chain strategies. The China+1 strategy, which began as a risk mitigation approach, has evolved into a comprehensive supply chain diversification initiative that could reshape the future of global manufacturing. For India, this shift presents both an unprecedented opportunity and a complex challenge.

The Changing Global Manufacturing Dynamics

Recent data paints a compelling picture of this transformation: China experienced a 17% decrease in greenfield manufacturing FDI between 2019 and 2023, while Southeast Asian nations witnessed a 20% increase during the same period. This shift isn’t merely a statistical anomaly but reflects a fundamental reorganization of global supply chains. In 2023, China received $13 billion in FDI, while countries like Indonesia and Vietnam attracted $33 billion and $16 billion in greenfield manufacturing FDI respectively.

India’s Growth Trajectory

India’s evolution in global trade tells a story of consistent progress. From a modest 0.5% share in global trade in 1990, the country has expanded its presence to 1.85% in 2023. This growth isn’t accidental but the result of systematic reforms and strategic initiatives. The share of merchandise and services trade in India’s GDP has surged from 15% in 1980 to 46% in 2023, underlining the country’s increasing integration into global value chains.

The India Opportunity

We had the opportunity to get the thoughts of Sandeep Singh, MD, Tata Hitachi Construction Machinery, on the unique opportunity facing India, and here’s what he had to say.

“Globalization has been under challenge from around 2017 following a rise in trade tensions between the United States and China, and more recently following Russia’s invasion of Ukraine, which has caused massive disruptions of financial, food, and energy flows across the globe. COVID-19 also increased the focus on economic security and on making supply chains more resilient as the pandemic exposed their vulnerability in many countries.

Recent developments add to this trend with ‘near shoring’, bringing manufacturing back closer home gaining traction. The concept of China +1 is to be seen in this context.

Seeing this opportunity, Indian government introduced targeted PLIs to attract quality investments from OEMs in selected areas of national & global economic interest that has attracted Rs.1.46L Cr of investments till date. There has been considerable success in areas like electronics & semiconductor manufacturing. Not only in manufacturing, even in services, investments have come in through the 1700+ Global Capability Centres (GCC) established in the country – more are planned in the future.

Even in the construction equipment industry, we have seen continued investments not only to address the domestic market, but also increased focus on exports – that grew by an impressive 49% last FY – as OEMs spread their manufacturing in line with the China +1 theme.

We believe investments will continue to come in various sectors, to take advantage of the incentives offered by the government and encouraging them in local production under Atmanirbhar Bharat. This is supported by the vast talent pool available at affordable costs.

Having said that, the government should continue to address the ease of doing business – factor costs, easing of various regulations, world class good quality infrastructure and widen sectors under PLI etc- both at Centre & states – as other countries in APAC are also attracting investments.”

Strategic Advantages Positioning India

Several factors combine to make India an attractive destination for manufacturing investments:

Demographic Dividend

India’s massive workforce, characterized by both skill and cost advantages, provides a sustainable competitive edge in labor-intensive manufacturing sectors. Unlike many Southeast Asian nations facing aging populations, India’s demographic dividend promises a steady labor supply for decades to come.

Market Size and Growth Potential

The robust domestic market offers manufacturers a unique dual advantage: a testing ground for products and a cushion against global demand fluctuations. With one of the world’s fastest-growing large economies, India’s market potential itself acts as a magnet for investments.

Policy Framework and Reforms

The government’s strategic initiatives have created a more conducive environment for manufacturing:

- Make in India program focusing on manufacturing sector development

- Atmanirbhar Bharat (Self-Reliant India) promoting domestic manufacturing capabilities

- Production Linked Incentive (PLI) scheme offering financial incentives for domestic production

- Revamped FTA strategy improving market access for Indian products

Challenges and Strategic Imperatives

Despite the optimistic outlook, several challenges need addressing for India to fully capitalize on the China+1 opportunity:

Infrastructure and Logistics

The document highlights that containerized cargo faces significant turnaround times – approximately 156 hours at ports and 128 hours at inland container depots. This indicates the need for both capacity expansion and technology-led process enhancement. The government’s emphasis on infrastructure development, particularly through initiatives like PM Gati Shakti, aims to address these bottlenecks.

Technology Modernization

“Technology fossilisation” emerges as a critical concern in the analysis. Indian manufacturers must accelerate their adoption of advanced manufacturing technologies to meet international quality standards and efficiency benchmarks. This includes both production technology and export process automation.

MSME Integration

Perhaps the most striking statistic is that only 1.36% of India’s MSMEs currently engage in exports. This represents both a challenge and an enormous opportunity. MSMEs face four key hurdles:

- Business environment constraints

- Complex export procedures

- Limited access to finance

- Insufficient market access and information

Environmental Compliance

The growing emphasis on climate change mitigation globally presents another challenge. Both pricing and non-pricing policies for climate mitigation have accelerated over the last decade, requiring exporters to address carbonization within their value chains.

The Path Forward

India’s ambition to achieve $1 trillion in merchandise exports by 2030 appears achievable under optimal conditions. Analysis suggests three possible scenarios:

- Optimistic: Achieving the target by FY29 with 18% annual export growth

- Business as usual: Reaching the goal by FY31 with 14.5% growth

- Conservative: Hitting the mark by FY33 with 10% growth

To realize the optimistic scenario, India needs to focus on:

- Value addition in manufacturing to prevent commoditization

- Market diversification through strategic trade agreements

- MSME export participation enhancement

- Technology modernization across the manufacturing sector

- Infrastructure development and logistics efficiency improvement

The Road Ahead

The China+1 strategy presents India with a historic opportunity to establish itself as a major global manufacturing hub. While Southeast Asian nations currently lead in capturing manufacturing shifts from China, India’s combination of market size, policy support, and strategic advantages positions it uniquely for the long term.

Success will require a coordinated effort from both government and industry to address structural challenges while maintaining reform momentum. The next few years will be crucial in determining whether India can translate this opportunity into reality and achieve its ambitious export targets.

The global supply chain transformation is underway. For India, the question isn’t whether to participate but how to maximize its share of this shifting manufacturing landscape.

You may like

-

Flipkart appoints Digbijay Mishra as new VP of Corporate Communications

-

Heavy hitting England face-off with India in Mumbai Semifinal

-

Fans roast Karan Aujla’s Mumbai concert

-

India’s Logistics Ambition on Full Display at Transport Logistic India and Air Cargo India 2026

-

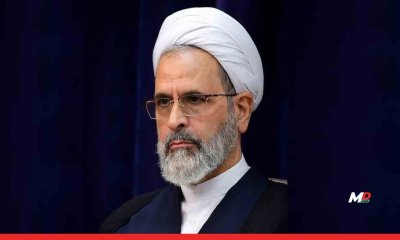

Report: Mojtaba Khamenei named new Supreme Leader of Iran

-

Who is Ayatollah Alireza Arafi, Iran’s interim Supreme leader?