Business

Gautam Adani Indicted in USA on Fraud and Bribery Charges

Published

1 year agoon

Billionaire and close associates charged with paying more than $250 million in bribes to obtain lucrative solar energy contracts, and hiding these payments from US investors

Gautam Adani, the Indian business magnate whose vast conglomerate spans industries from energy to infrastructure, now finds himself at the centre of a storm that threatens to upend his empire. US Prosecutors indicted the Indian billionaire on multiple counts of fraud, accusing him and associates of bribing Indian officials and later lying to investors about the scheme.

At the heart of the matter lies Adani Green Energy, a subsidiary focused on renewable power generation. Prosecutors allege that this entity, along with its associates, engaged in a systematic campaign of corruption to secure lucrative contracts in India’s burgeoning solar energy sector. The scale of the alleged wrongdoing is staggering, with purported bribes exceeding $250 million and contracts valued in the billions.

The Charges: Unmasking a Multifaceted Fraud

The indictment brought forth by the U.S. Attorney’s Office for the Eastern District of New York presents a damning portrait of corporate misconduct on a grand scale. At its core, the charges allege a sophisticated bribery scheme designed to secure lucrative contracts in India’s renewable energy sector, followed by a concerted effort to mislead investors about the true nature of these dealings.

Bribery Allegations: The Foundation of the Case

The prosecutors’ narrative begins with accusations of widespread bribery targeting Indian government officials. According to the indictment, Adani Green Energy, a subsidiary of the larger Adani Group, allegedly orchestrated payments exceeding $250 million to various officials. These bribes were purportedly aimed at securing contracts for solar energy projects, a sector that has seen explosive growth in India in recent years.

The scale of the alleged corruption is noteworthy not just for its monetary value, but also for its apparent reach within the Indian government. Prosecutors claim that Gautam Adani himself was directly involved in discussions about these illicit payments, suggesting a level of complicity that extends to the very top of the corporate hierarchy.

Securities Fraud: Deceiving Investors

Building upon the foundation of the bribery allegations, the charges extend into the realm of securities fraud. The indictment contends that Adani Green Energy, in its efforts to raise capital from U.S. and international investors, made false and misleading statements about its anti-corruption and anti-bribery practices.

This aspect of the case is particularly significant as it brings the alleged misconduct squarely into the jurisdiction of U.S. law enforcement. By targeting American investors with what prosecutors describe as fraudulent information, the company potentially violated several U.S. securities laws, including provisions of the Foreign Corrupt Practices Act (FCPA).

The Scope of the Indictment

The charges are not limited to Gautam Adani alone. Several other executives and associates have been named in the indictment, including:

- Sagar R. Adani, Gautam Adani’s nephew

- Vneet S. Jaain (not a typo), another executive at Adani’s energy company

- Former employees of a Canadian institutional investor

These individuals are accused of various roles in the alleged scheme, from direct involvement in bribery to conspiracy to obstruct investigations. The inclusion of multiple defendants across different organizations suggests a complex network of complicity, further underscoring the gravity of the accusations.

Tracking the Alleged Bribes

One of the more intriguing aspects of the case is the level of detail provided by prosecutors regarding the alleged bribery scheme. The indictment describes a system of record-keeping that utilized messaging apps, phones, and even PowerPoint presentations to track bribes and offers to Indian officials.

Prosecutors claim that the defendants used code names in their communications, referring to Gautam Adani variously as “SAG,” “Mr. A,” “Numero uno,” and “the big man.” Such details not only add color to the allegations but also suggest a level of premeditation and organization that could prove damning if substantiated.

The Role of Adani Green Energy

Central to the case is the role played by Adani Green Energy, the renewable energy arm of the Adani Group. Prosecutors allege that this entity was the primary vehicle through which the bribery scheme was executed. The company is accused of winning contracts with the Solar Energy Corporation of India, a state-owned enterprise, through corrupt means.

The indictment further claims that Adani Green Energy then sought to raise funds from investors based on these tainted contracts, without disclosing the true nature of how they were obtained. This alleged deception forms the basis of the securities fraud charges.

As the legal proceedings unfold, the intricate details of these charges will undoubtedly be scrutinized by both the defense and the prosecution. The outcome of this case could have far-reaching implications not just for the Adani Group, but for corporate governance and international business practices as a whole.

The Players: Key Figures in the Adani Scandal

The Adani scandal involves a cast of characters that spans corporate boardrooms, government offices, and international financial institutions. Understanding the roles and relationships of these key figures is crucial to grasping the full scope of the allegations and their potential implications.

Gautam Adani: The Man at the Center

At the epicenter of this controversy stands Gautam Adani, one of the world’s wealthiest individuals and the founder of the Adani Group. Known for his meteoric rise in the business world, Adani has built a conglomerate that touches nearly every aspect of India’s economy, from ports and power plants to airports and data centers.

Adani’s journey from a small-time diamond trader to a global business tycoon has been nothing short of remarkable. His close ties to Indian Prime Minister Narendra Modi have long been a subject of discussion, with critics alleging that this relationship has helped fuel the rapid expansion of his business empire.

In the context of the current charges, Adani is accused of being directly involved in discussions about the alleged bribery scheme. His role as the figurehead of the Adani Group places him squarely in the crosshairs of both legal scrutiny and public opinion.

Sagar R. Adani: The Next Generation

Sagar R. Adani, Gautam Adani’s nephew, is another key figure named in the indictment. As a member of the younger generation of the Adani family, Sagar’s involvement suggests a potential succession plan within the family business that may now be in jeopardy.

Prosecutors allege that Sagar played a significant role in tracking the details of bribes offered to officials, using his cellphone to maintain records of payments and corresponding solar power purchases. This level of hands-on involvement, if proven, could have serious consequences for both Sagar personally and the future leadership of the Adani Group.

Vneet S. Jaain: The Executive

Vneet S. Jaain, an executive at Adani’s energy company, is also named in the indictment. His alleged involvement adds another layer to the corporate structure implicated in the scandal. The charges against Jaain highlight the extent to which prosecutors believe the alleged misconduct permeated various levels of the organization.

The Canadian Connection

The indictment also mentions former employees of a Canadian institutional investor, including an individual named Deepak Malhotra. These individuals are accused of conspiring to violate the Foreign Corrupt Practices Act and obstruct investigations into the bribery scheme.

The involvement of international players underscores the global nature of the alleged fraud and raises questions about the role of foreign investors in the Adani Group’s operations.

Indian Government Officials

While not named specifically in the U.S. indictment, various Indian government officials are implicated as recipients of the alleged bribes. The charges suggest that officials from multiple states, including Andhra Pradesh, Odisha, and Jammu and Kashmir, were involved in the scheme.

The alleged participation of government officials at various levels adds a political dimension to the scandal, potentially implicating India’s bureaucratic and regulatory systems.

The Bribery Component

According to prosecutors, the bribery scheme began to take shape between December 2019 and July 2020. During this period, Adani Green Energy and another renewable energy company listed on the New York Stock Exchange won contracts with the Solar Energy Corporation of India (SECI), a state-owned enterprise tasked with promoting renewable energy in the country.

The contracts were substantial, involving a $6 billion investment in solar energy that was expected to generate more than $2 billion in profit after taxes over a 20-year period. However, the energy produced was expensive, and SECI struggled to find customers willing to sign on.

This is where the alleged bribery scheme came into play. Prosecutors claim that in 2020, Gautam Adani and his associates began using bribes to convince Indian states to purchase their solar energy. The scale of the alleged bribes is staggering:

- Approximately $265 million in total bribes promised

- $228 million allegedly offered to a single unnamed official in Andhra Pradesh

- Bribes linked to the purchase of seven gigawatts of solar energy

The indictment suggests that between 2021 and February 2022, several Indian states and regions, including Odisha and Jammu and Kashmir, agreed to sign up for the solar power. This period coincides with the alleged expansion of the bribery scheme to include more individuals, including former employees of a Canadian institutional investor.

The Investor Deception

The second component of the alleged scheme involved misleading investors about the nature of these contracts and the company’s anti-corruption efforts. Prosecutors claim that between 2020 and 2024, Gautam Adani and his associates provided false and misleading information to investors while raising money for their energy ventures.

Specific instances of alleged deception include:

- Lying to investors when Adani businesses took out a $1.35 billion loan in 2021

- Misleading statements during the issuance of $750 million in bonds in 2021

- Failure to disclose U.S. investigations into their business practices in 2023 and 2024

These actions, if proven, would constitute securities fraud, a serious offense under U.S. law.

The Mechanics of the Alleged Scheme

The indictment provides intriguing details about how the scheme was allegedly executed:

- Record-keeping: Sagar Adani is accused of using his cellphone to track details of bribes offered and promised to officials. For each official, he allegedly recorded:

- Their state or region

- The amount offered

- The amount of solar power their region would purchase in exchange

- Code names: The defendants allegedly used code names in their communications to obscure identities:

- Gautam Adani: “SAG,” “Mr. A,” “Numero uno,” “the big man”

- Vneet S. Jaain: “V,” “snake,” “Numero uno minus one”

- Coverup attempts: The indictment claims that some defendants discussed deleting “incriminating electronic materials,” including emails, messages, and a PowerPoint analysis.

The Timeline of Events

The alleged scheme unfolded over several years:

- 2019-2020: Initial contracts secured with SECI

- 2020: Bribery scheme allegedly begins to convince states to purchase solar energy

- 2021-2022: Multiple states sign up for solar power; bribery scheme expands

- 2021: Misleading statements allegedly made during loan and bond issuances

- 2023-2024: Failure to disclose U.S. investigations

This timeline suggests a prolonged period of alleged misconduct, potentially complicating both the prosecution’s case and any potential defense strategies.

The Role of Political Connections

While not directly part of the charges, the indictment alludes to the political connections that may have facilitated the alleged scheme. Gautam Adani’s relationship with Indian Prime Minister Narendra Modi has long been a subject of scrutiny, and the charges raise questions about the extent to which political influence may have played a role in the Adani Group’s rapid expansion.

As the legal proceedings unfold, the intricate details of this alleged scheme will undoubtedly be subject to intense scrutiny. The complexity of the accusations, spanning multiple years and involving various entities and individuals, presents significant challenges for both prosecutors and defense attorneys. The outcome of this case could have far-reaching implications for corporate governance, international business practices, and the future of renewable energy investments in emerging markets.

This isn’t the first time Adani has been accused of underhanded tactics. Hindenburg research has, on two occasions, laid out explosive allegations against the conglomerate, going so far as to call it the “largest con in corporate history”. While those charges were pooh-poohed and Adani was given a somewhat questionable clean chit, this indictment is a body blow to Ambani’s image. It will be interesting to see if Adani attempts to deflect this too as an attack on India rather than on himself, as he has previously.

You may like

-

Flipkart appoints Digbijay Mishra as new VP of Corporate Communications

-

Heavy hitting England face-off with India in Mumbai Semifinal

-

Fans roast Karan Aujla’s Mumbai concert

-

India’s Logistics Ambition on Full Display at Transport Logistic India and Air Cargo India 2026

-

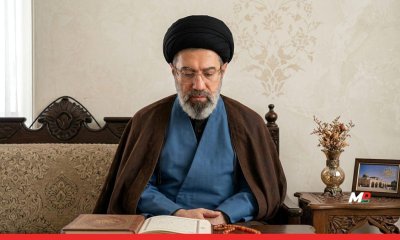

Report: Mojtaba Khamenei named new Supreme Leader of Iran

-

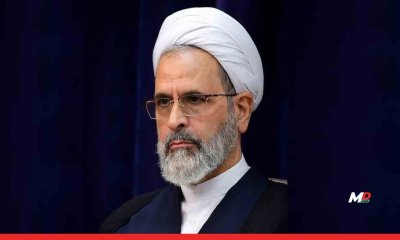

Who is Ayatollah Alireza Arafi, Iran’s interim Supreme leader?