Business

India’s stock market soars to unprecedented $5 Trillion milestone

Published

2 months agoon

The journey to this historic landmark has been an extraordinary growth story. Under British rule, India’s GDP share dwindled, and by the end of British rule, India’s economy represented a much smaller proportion of global GDP, falling to 12% in1870, and to 4% by 1947. Cut to 2023, when India’s share of global GDP was estimated at 9.6% once allowances were made for base year and informal economy size.

2024 has been a memorable year for Indian bulls. In less than six months, the Indian stock market has added a staggering $1 trillion to its market capitalization, a pace never before witnessed in its history. This remarkable surge has defied the pullout of foreign institutional investors (FIIs) and has been fueled by the unwavering confidence of domestic institutional, retail, and high-net-worth individual (HNI) investors.

India’s rapid rise to the $5 trillion club

The Indian stock market’s ascent to the $5 trillion mark is a remarkable feat that has been achieved in record time. Starting from the $4 trillion milestone on November 29, 2023, the market has soared to new heights, crossing the $5 trillion threshold on May 21, 2024. This rapid growth has been driven by a combination of factors, including the robust performance of the broader market, the resilience of the Nifty and Sensex indices, and the surge in mid and small-cap stocks.

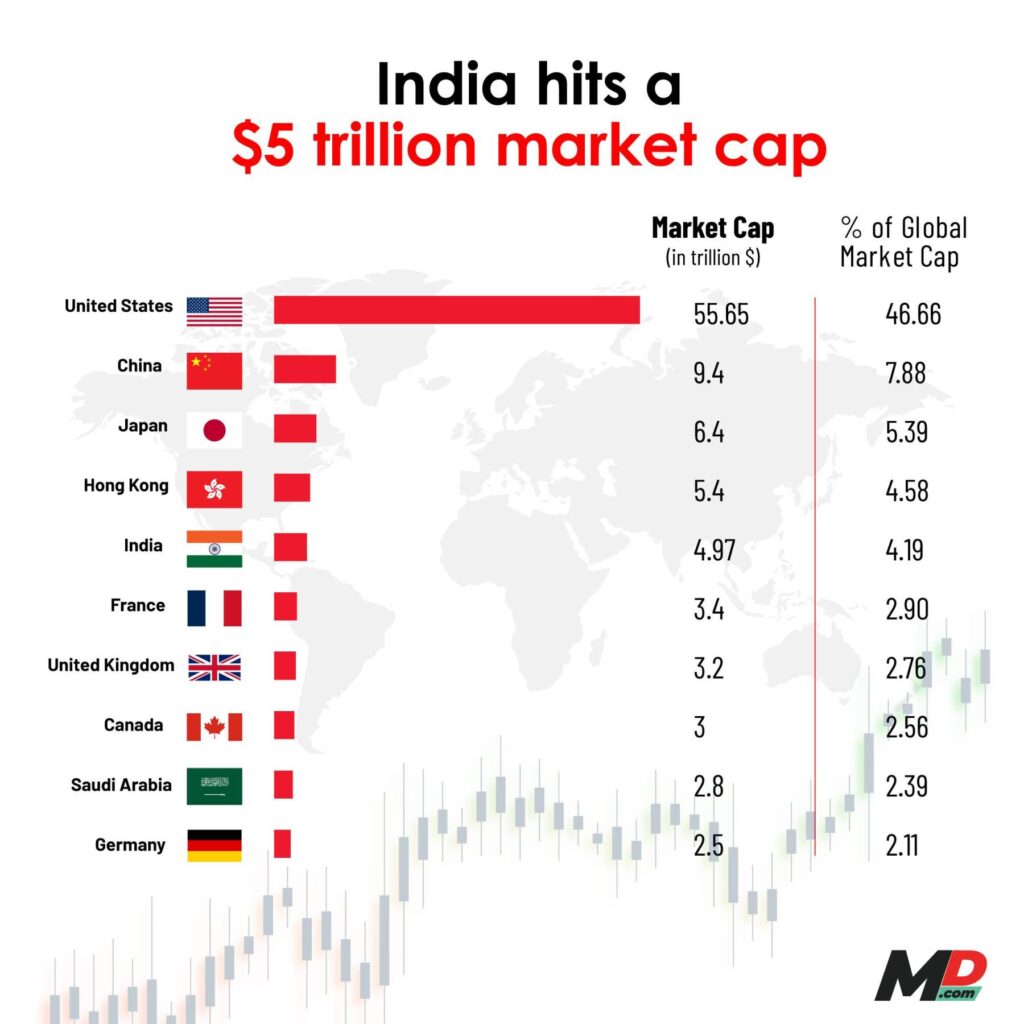

With this historic achievement, India has solidified its position as the fifth-largest stock market in the world, trailing only financial powerhouses like Hong Kong, Japan, China, and the United States. The significance of this milestone cannot be overstated, as it cements India’s status as a formidable player in the global financial landscape.

The Indian stock market’s journey to the $5 trillion mark has been marked by an unprecedented wealth creation frenzy. In just six months, the market has added $1 trillion to its market capitalization, a feat that has been largely driven by the influx of domestic institutional, retail, and HNI investors. This surge in domestic capital has more than offset the pullout of FIIs, underscoring the growing strength and resilience of the Indian investment community.

The rapid pace of wealth creation

The pace at which the Indian stock market has reached the $5 trillion milestone is truly remarkable. It took the market a decade to move from the $1 trillion mark to the $2 trillion level, but the subsequent journey to $3 trillion and now $5 trillion has been significantly faster, highlighting the accelerating momentum of the Indian markets.

Looking ahead, analysts are bullish on India’s stock market, projecting that it could reach the $10 trillion mark by 2030. This optimistic forecast is based on the assumption that the market will continue to deliver strong returns in line with its performance over the past 15-20 years, as well as the anticipated surge in new listings, including the potential IPOs and FPOs of Indian unicorns and the expected listing of Reliance Jio and Reliance Retail.

The growth of the Indian stock market has also been accompanied by a significant increase in its depth and liquidity. The number of stocks with a market capitalization of $1 billion or more has nearly doubled to 500 over the past few years, providing ample opportunities for large investors and ensuring sufficient liquidity in the market.

India’s rising prominence in the MSCI Emerging Markets Index

The Indian stock market’s ascent to the $5 trillion milestone has also been reflected in its growing prominence within the MSCI Emerging Markets (EM) index. The country’s weightage in the index is set to increase from 18.3% to closer to 19% from May 31, 2024, which is expected to attract further foreign institutional investment worth around $2.5 billion.

The surge in the Indian stock market’s market capitalization is not just a financial milestone; it is also a testament to the country’s broader economic transformation. According to Jefferies, India is poised to become the world’s third-largest economy by 2027, overtaking Japan and Germany, driven by the tailwinds of its favorable demographics, improving institutional strength, and advancements in governance.

The increasing prominence of Indian Unicorns and the IPO boom

The growth of the Indian stock market has also been fueled by the rise of Indian unicorns, which have amassed a cumulative funding of $100 billion and a valuation of around $350 billion. As these unicorns, such as Flipkart, Swiggy, Ola Electric, and PhonePe, start to mature, they are expected to list on domestic exchanges, further boosting the market’s capitalization and liquidity.

Analysts estimate that the Indian stock market could see a surge in IPO and FPO activity over the next 5-7 years, potentially reaching 4-5% of the market’s total capitalization. This influx of new listings, driven by the maturation of Indian unicorns and the triggering of a new capital expenditure cycle, is expected to provide a significant boost to the market’s growth and solidify its position as a premier investment destination.

You may like

-

Paris 2024 Olympics: 5 of the most stylish uniforms on show

-

FM showers special love on Bihar and Andhra Pradesh in Budget 2024, as Opposition leaders cry “Kursi Bachao”

-

DreameIndia Appoints Manu Sharma as Managing Director to lead its India Operations and Market Expansion

-

Amazon eyes Swiggy Instamart to boost Quick Commerce in India

-

Economic Survey urges creation of 78.51 Lakh non-farm jobs annually

-

Explained: The significance of Savan in India