BFSI

Will Jio BlackRock disrupt India’s Asset Management Industry?

Published

3 years agoon

The emergence of Jio BlackRock might well be a watershed moment for India’s asset management industry

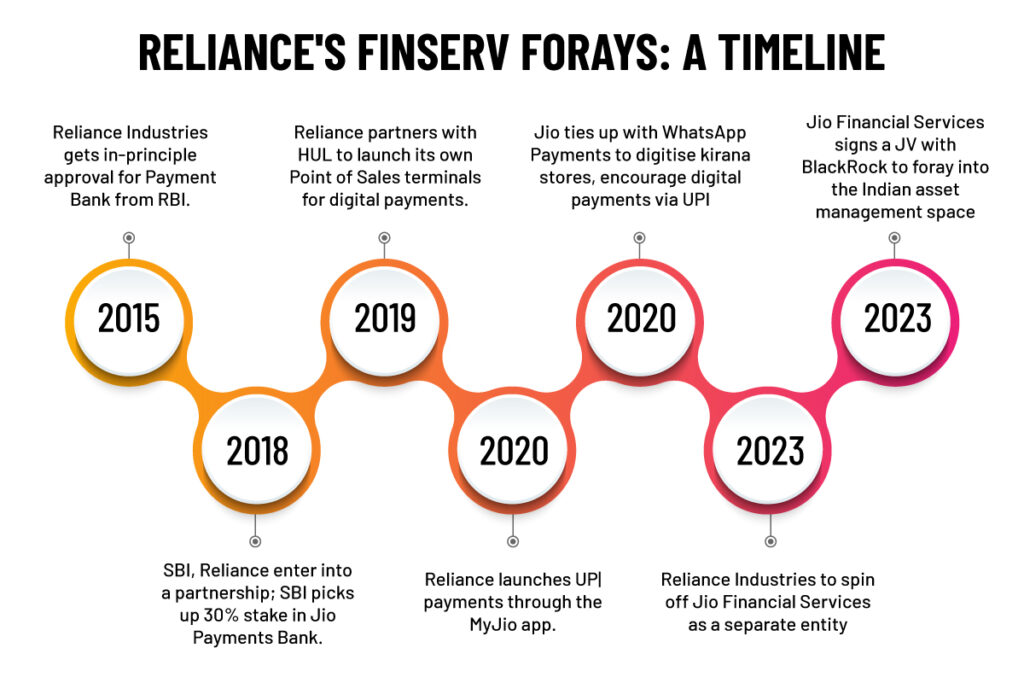

In what is perhaps another Jio moment for the asset management industry, Jio Financial Services and BlackRock have announced the formalisation of a Joint Venture (JV) to form a 50:50 joint venture to offer investment solutions. Called Jio BlackRock (expectedly), the two companies will target an initial investment of $150 Mn each in the newly formed digital-first entity.

Just as it was when Jio hit the market, people are wondering; will this be a red-letter moment for the Indian asset management industry? It might well be, for this is the coming together of two titans, who are looking to set sail into the wild blue yonder on the rising tide of a wave of Indian aspirations and affluence.

“Today marks a major move for BlackRock as we work to expand our footprint through a forthcoming joint venture in India with Jio Financial Services, a company built by Reliance Industries Limited”

- Larry Fink, Chairman and CEO of BlackRock

The return of a behemoth

After previously exiting the Indian market, when BlackRock sold its 40% stake in DSP BlackRock to DSP Group, many were unsurprised by the exit of yet another foreign asset manager from the Indian mutual fund industry. It is a long list, more than most remember, dating back to Dundee Mutual Fund in the ‘90s and including Newton Investments UK, Capital International, Morgan Stanley, JP Morgan, ING and Deutsche, to name a few. The word on the street at the time was that BlackRock wanted complete control, and did not want to sully its spotless global record, with extra precautions taken when it comes to processes, risk and compliance.” Rumour wanted 100% ownership of the fund business.

Now, the return of the investment major comes at an opportune time, when India stands as the fastest-growing major economy with the largest youth population in the world. And as a digital-first entity, the upside of tapping into India’s digital savvy young user base is too good to ignore, even for BlackRock. That more people play fantasy cricket than dabble in mutual fund folios or demat accounts simply underlines the heavily underexposed nature of equity investing in India.

By 2030, India is expected to become the world’s 4th largest economy, have an urban population of 600 million, and account for 20% of the world’s working population. And yet, the penetration of India’s Mutual Fund Assets Under Management (AUM) to GDP ratio is significantly lower at 16 per cent in March-2022, compared to the world average of 75%. By focusing on creating a range of made-for-India investment products aimed at Bharat, digitally-driven financial inclusion can drive growth in this space, and that’s where Jio BlackRock hopes to score a winner.

But make no mistake of it, BlackRock is a behemoth. For perspective, the total mutual fund market in India is around Rs. 45 lakh crore ($542 billion). BlackRock alone has $9.4 trillion assets under management at the end of June, of which $2.9 trillion is associated only towards ETFs (exchange-traded funds), a figure dwarfed only by Vanguard Group. Around $4.4 trillion is in equities, and nearly half of this is tied to the emerging markets. So India’s market is too tiny to even warrant a mention, with around 42 companies vying for that pie.

So, why does India matter for BlackRock?

While passive funds such as ETFs are seeing a growth uptick across the globe, and BlackRock itself attracted $39 billion across its 408. If Bloomberg analysis is to be believed (and there’s no reason it shouldn’t), this works out to 15% of the industry’s $263 billion year-to-date inflows. That’s an impressive number for most businesses, but that is BlackRock’s lowest share since 1999.

With JPMorgan Asset Management shaking up the establishment with a very strong year in the $7.6-trillion U.S. ETF industry, this puts further pressure on BlackRock to respond to the challenge to its incumbency and supremacy. What’s more, with the Federal Reserve rolling out an aggressive tightening campaign, investors are looking for more actively managed funds. BlackRock’s India foray was always an inevitability in these circumstances.

Speaking of actively managed funds, the SPIVA India scorecard for the year 2022 notes how a significant proportion of actively managed Indian equity large-cap funds were unable to surpass their benchmark, with a substantial 88% of actively managed schemes falling short of the S&P BSE 100. This pattern played out over three-year and five-year periods as well, even more starkly, standing at 96.7% and 93.8% respectively. Without a doubt, SEBI’s stringent regulations pertaining to the composition of large-cap funds further contribute to the challenge of achieving superior performance. Consequently, passive alternatives have gained considerable popularity within the realm of large-cap options. When viewed together, these are the factors that drive investors towards passively managed options.

Simply put, combining BlackRock’s proven expertise in building out passive investment solutions that offer higher returns than traditional asset classes such as debt and equity with Jio’s significant distribution muscle across physical and digital touchpoints creates a push and pull factor that is too large to be ignored. Sure, there might be retail investment opportunities on offer too, but a tech-first business model is tailor-made for a passive investment model thanks to lower upfront costs, thanks to Jio’s massive distribution capabilities. BlackRock’s global credibility and strong brand value is just the cherry on top, as is the possibility that Aladdin, BlackRock’s famed analytics engine, could be made use of.

Building for the future

India’s AUM, as mentioned as being $542 billion earlier, represents a doubling over figures from 5 years back, representing a scaling up from the time BlackRock exited the Indian market. Since then, a number of companies are dipping their toes into asset management and merchant lending, and Jio BlackRock could well be the shark in the water for competition.

Jio BlackRock represents a bet on the India that can be. The India that could become the third-largest economy in the world by fiscal year 2028. The India that could increase its exposure to investments manifold. The India that could be a 5 trillion dollar economy by 2030. And if that does come to pass, there will be enough pie for Jio BlackRock and other companies to feast on for a long time to come.

“The convergence of rising affluence, favourable demographics and digital transformation across industries is reshaping the market in incredible ways.”

- Rachel Lord, Head of Asia-Pacific, BlackRock

So, to answer the question, is this a Jio moment for the asset management industry, just as we see a telecom duopoly at play now after Jio rewrote the rules of engagement? I would wager a guess and say perhaps not. Jio BlackRock will not make waves as Jio did in the telco space. People matter tremendously, and savvy fund and investment managers will still thrive across actively funded funds. Where we might see a perceptible shift is in low-cost funds, where BlackRock’s know-how around passive fund investing could prove priceless in offering an affordable, value-for-money product that appeals to Indians everywhere. And if that sounds like a textbook strategy from Jio’s playbook, that’s because it is. How it plays out remains to be seen.

You may like

-

Union Budget 2026: The verdict from the Boardroom is in

-

Union Budget 2026: All the key announcements made by the FM

-

Maharashtra Deputy Chief Minister Ajit Pawar passes away after plane crash near Baramati

-

Deepinder Goyal resigns as Eternal CEO; Blinkit’s Albinder Dhindsa to take the helm

-

📈 Markets Open Strong : Voltas in Focus Amid Recovery Hopes

-

Couple attends own wedding virtually after being stranded by IndiGo