Published

8 months agoon

For over a century, New India Assurance (NIA) has been an iconic symbol of service, reliability, and trust among insurance players in India. The government-owned business that started with the initiative of Sir Dorabji Tata back in 1919 had an idealism embedded within its business philosophy based on people’s safety, supporting national growth, and expanding the market to masses. As time passed and the business landscape changed, the company has evolved—and yet not lost its original values. Now, in an environment filled with digital disruption, rising competition, and growing customer expectations, NIA retains policyholder trust by smartly combining tradition with technology, and heritage with agility.

A Nationwide Network:

New India Assurance’s extensive reach in India—1680 offices—has always been one of its prime drivers of credibility and outreach. Its reach covers insurance penetration in all corners of the country, including metros and remote rural belts, remaining faithful to its vision of inclusive coverages right from the start.

Every office manifests the commitment of the company to be there in body and be accessible to the ordinary citizen. Such wide coverage is particularly relevant in a nation like India, where physical presence remains a decisive factor in fostering trust. The regional offices of the company are also best placed to tap local socio-economic complexities and customer bases, and tailor service delivery as well as local risk underwriting, yet further enhancing policyholder trust.

Digital Transformation: Bridging Heritage and Modern Expectations

Though its physical network guarantees presence, it is New India Assurance’s digital revolution that guarantees relevance. Since it was realized that the policyholders of today require speed, convenience, and transparency, the company has invested heavily in its digital setup.

By streamlining these interactions, New India Assurance has not only minimized turnaround times but also increased customer satisfaction and operational efficiency. Notably, the company’s digital strategy is inclusive—rather than disruptive—aimed at supplementing instead of supplanting traditional channels. This hybrid model guarantees that both technologically advanced millennials and rural first-time policyholders experience value and convenience in interacting with the company.

Claims efficiency:

The true test of any insurance relationship comes at the moment when a customer lodges a claim. A firm’s reputation is built more upon its prompt settlement, fairness, and sensitivity in the claims process than through any advertisement campaign ever done.

New India Assurance has understood this and has made provisions to:

Therefore, NIACL has a high claim settlement rate within regulatory timeframes, and continues to be appreciated by both retail and corporate clients for its consistency and transparency.

The Indian general insurance sector is now intensely competitive with many private players, digital insurers, and international joint ventures joining the game. But New India Assurance stands out based on a blend of brand heritage, social obligation, and customer loyalty.

By remaining consistent to its public service tradition while selectively embracing best practices to deliver the best to the policyholders, NIACL treads a distinctive path that generates both trust and competitiveness.

Empowering employees:

At the heart of the company’s success lies its people. New India Assurance continues to invest in employee training, upskilling, and leadership development—equipping them to handle the demands of a digital-first world while still delivering empathetic, people-centric service.

Future-ready:

Going forward, New India Assurance is geared up to meet these challenges:

To stay current, the company is incorporating sustainability targets, intelligent analytics, and worldwide best practices into its risk frameworks and governance systems. While doing so, it continues to prioritize offering affordable insurance cover to policyholders.

In an era where digital disruption can overwhelm legacy institutions at a whim, New India Assurance demonstrates that adaptability and authenticity are not enemies. By holding fast to its original vision of service, accessibility, and trust—and by leveraging contemporary tools that improve transparency and efficiency—the company continues to earn the respect of its policyholders, stay relevant in a competitive marketplace, and set the path forward for India’s insurance industry.

With every policy underwritten and every claim paid, New India Assurance renews its century-old vow: to be there for each customer—strong, steady, and future-strong.

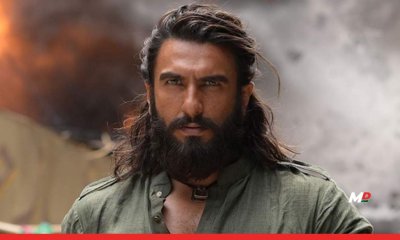

5 major takeaways from the trailer of Dhurandhar 2

What is the “Value Creation Zone”, and how can you make it work for you?

Ranveer Singh’s Dhurandhar 2 breaks records with 2 lakh+ preview tickets sold

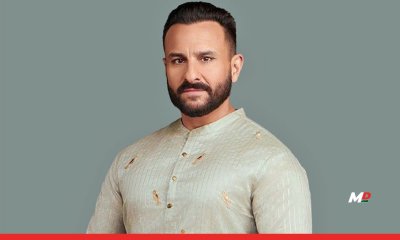

Saif Ali Khan weighs in on Bollywood’s pay gap

From the mic to the mountain throne, Nepal’s Rapper-Turned-Leader Reshapes a Nation

Shah Rukh Khan, Virat-Anushka, Akshay Kumar, and more celebrate as India lifts the T20 World Cup