Published

2 years agoon

In recent months, Mumbai’s real estate market has been witnessing unprecedented growth, with property registrations skyrocketing by 11% compared to last year. April alone saw over 10,000 units registered, marking a significant milestone. Moreover, transactions in Mumbai Metropolitan Region (MMR) surpassed Rs 60,000 crores, reflecting the region’s thriving real estate sector.

Top real estate experts attribute this surge to various factors, including new policies, infrastructure development, increased foreign investments, and rising demand for residential properties. Mumbai is currently undergoing a massive transformation in terms of infrastructure, with projects like the 331 km metro rail network and the Mumbai Trans-harbour link corridor underway. These initiatives are not only enhancing connectivity but also fuelling the demand for real estate in both Mumbai and its peripheral areas, such as Navi Mumbai.

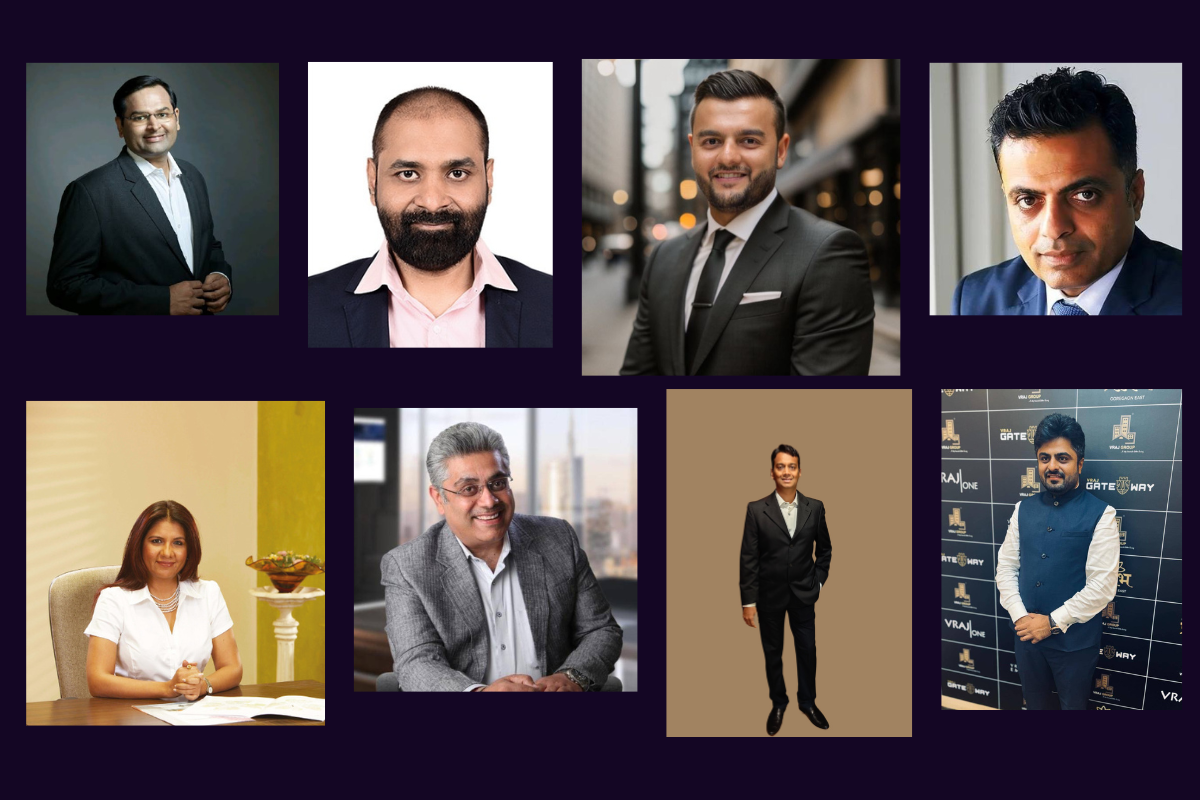

Ms. Manju Yagnik, Vice Chairperson of Nahar Group and Senior Vice President of NAREDCO- Maharashtra, sheds light on the diverse factors currently shaping Mumbai’s and the Mumbai Metropolitan Region’s (MMR) real estate landscape. With a primary focus on government-led infrastructure development initiatives, the real estate sector experiences a transformative shift. Projects like the Navi Mumbai International Airport and the Mumbai Coastal Road Project enhance connectivity, elevating the region’s appeal. The emergence of ‘Third Mumbai,’ a new city, signifies urban expansion and development opportunities. This infrastructure boom not only improves quality of life but also attracts investors and residents alike.

Ms. Yagnik further added that the recent 11% surge in property registrations in April signals a market resurgence, fuelled by affordable rates, developer incentives, and low home loan interest rates. While the youth increasingly aspire to homeownership, viewing real estate as a lucrative investment, strategic planning remains crucial for success in Mumbai’s dynamic market.

Hitesh J Thakkar, Vice President, NAREDCO Maharashtra, highlights the younger generation’s role in driving property purchases, citing factors like job security, developmental initiatives, and infrastructure enhancements, enticing both domestic and international investors.

Keval Valambhia, COO, CREDAI, advocates for a separate affordable housing index for metro cities to lower costs and boost livelihoods. He stresses the sector’s significant contribution to GDP, echoing economist Thornburg’s view on real estate’s pivotal role in the economy.

He further added that, Investing in real estate within the Mumbai metropolitan region can prove lucrative with diligent research and a long-term perspective. Historically, properties in this area have demonstrated appreciation, making them appealing investments.

Additionally, the government’s emphasis on infrastructure and urban renewal projects enhances the potential for capital growth in select areas. However, investors must be cautious, diversify their investments, and seek expert guidance to manage risks effectively.

Sandeep Sonthalia, CEO of Township at Wadhwa Group, delves into dynamic factors influencing Mumbai and MMR’s real estate, citing economic conditions, infrastructure projects, and government policies shaping market dynamics, attracting international investors. Recent developments in India’s real estate market drawing the attention of international investors include regulatory reforms aimed at enhancing transparency and ease of doing business, such as the introduction of Real Estate Regulatory Authority (RERA), demonetisation and the implementation of Goods and Services Tax (GST). Additionally, the growth of the commercial real estate sector has attracted international investors due to favourable rental yields and strong demand from multinational corporations.

Kunal Chheda, CEO Awas Advisory, said, “The surge reflects positive economic indicators like rising incomes, job security, and enhanced infrastructure, fostering transaction volumes.

He further added that for most buyers, especially youth, purchasing a first home is emotionally driven rather than solely logical. They’re exposed to various asset classes, but view home buying as a security measure rather than an investment, emphasising stability over returns. Transparency and professionalism stand out as key attractions for international investors across asset classes and regions. As stakeholders, we should collectively work towards fostering these values within our organisations.

Jay Morzaria, Director, Vraj Group, Founder National President Naredco Nextgen & Managing Committee, Naredco Maharashtra said, “Transformative Infrastructure, Regulatory Reforms, Adapting Lifestyles, Financial Favourability, and Global Attention are propelling Mumbai’s real estate boom. The recent 11% surge in April property registrations signals a rebound in confidence and activity, reflecting favourable economic sentiments and renewed homeownership interests. Today’s youth are embracing real estate, lured by stability and investment opportunities. Investing in Mumbai promises substantial returns despite fluctuations, with the commercial sector attracting global investors. Mumbai’s real estate is a dynamic landscape ripe with potential, driven by transformative developments, evolving lifestyles, and growing investor interest.”

Chintan Vasani, Wisebiz Realty said, “Diverse factors are driving Mumbai’s and MMR’s real estate market, fueled by a surge in end-user demand amid economic expansion. The 11 percent increase in property registrations in April highlights sustained demand, supported by robust economic growth. Today’s youth actively participate in home purchasing, influenced by social media and informed decision-making. Recent developments, including India’s growing economy and infrastructure projects like Mumbai’s Metro, attract international investors, particularly NRI’s, keen to join the country’s growth trajectory. These factors underscore the thriving real estate landscape in Mumbai and MMR, promising continued growth and investor confidence.

Bhavik Mehta, Founder partner, Namo Realty said, ” the Mumbai and MMR real estate market is shaped by diverse factors, including infrastructure, government policies, economic stability, and changing demographics. Key influences include infrastructure projects like the Mumbai Metro and coastal road, government initiatives like reduced stamp duty rates, and economic indicators like job creation and income levels. The recent 11% rise in property registrations in April reflects positive market sentiment, possibly driven by attractive pricing and ownership aspirations. Millennials’ home buying preferences prioritise affordability and amenities. Strategic real estate investment, considering location and long-term growth, can be rewarding. International interest is piqued by REITs, Smart Cities Mission, and high-yield commercial properties. However, prudent research and financial advice are essential for investors.”

5 major takeaways from the trailer of Dhurandhar 2

What is the “Value Creation Zone”, and how can you make it work for you?

Ranveer Singh’s Dhurandhar 2 breaks records with 2 lakh+ preview tickets sold

Saif Ali Khan weighs in on Bollywood’s pay gap

From the mic to the mountain throne, Nepal’s Rapper-Turned-Leader Reshapes a Nation

Shah Rukh Khan, Virat-Anushka, Akshay Kumar, and more celebrate as India lifts the T20 World Cup