Published

1 year agoon

In recent years, the allure of cryptocurrencies has spread beyond India’s metropolitan cities, captivating investors in smaller towns and rural areas. Despite the Indian government’s stringent tax regime on virtual digital assets (VDAs), the crypto craze remains undeterred. This phenomenon highlights the evolving financial landscape and the innovative strategies adopted by investors, including leveraging tax loopholes to minimize liabilities.

India’s lesser-known cities like Botad in Gujarat, Barbaka in Assam, and Kanchipuram in Tamil Nadu have emerged as burgeoning hubs of cryptocurrency trading, according to a report by Coinswitch. Reports suggest that the demographic driving this trend primarily consists of individuals under 35, who are diversifying their investments into meme coins, DeFi tokens, and layer-one assets such as Bitcoin and Ethereum.

The growing interest stems from the potential for high returns and the decentralized nature of cryptocurrencies, which offer an alternative to traditional investment avenues. Platforms like CoinSwitch have noted a significant uptick in crypto activity from tier-two and tier-three cities, underscoring a democratization of access to digital assets.

“What was once concentrated in major metros is now quickly expanding to smaller towns, reflecting the growing appeal of crypto as an investment class,” sais Balaji Srihari, VP at CoinSwitch.

This surge in crypto adoption comes despite the imposition of steep taxes: a flat 30% tax on crypto gains and a 1% tax deducted at source (TDS) on transactions exceeding ₹50,000 annually. While these measures aim to curb speculative trading and increase government revenue, they have not deterred small-town investors. On the contrary, many are actively exploring legal loopholes to minimize their tax burdens.

The case of a former Infosys employee in Bengaluru exemplifies how some investors have successfully navigated the complexities of India’s tax laws. In a landmark ruling by the Jodhpur Income Tax Appellate Tribunal (ITAT), this individual managed to pay just ₹33 lakh in taxes on a staggering profit of ₹6.64 crore from selling Bitcoin.

Here’s how it unfolded:

This case underscores the importance of timing and documentation in crypto investments. By proving the non-speculative nature of his investment and reinvesting gains strategically, the Bengaluru techie not only minimized his tax liability but also set a precedent for others to follow.

Several factors explain the growing interest in cryptocurrencies among small-town investors:

India’s crypto tax regime underwent a significant overhaul with the Finance Act of 2022, which introduced specific provisions for VDAs. Here are the key highlights:

While the tax framework seeks to regulate the burgeoning crypto market, challenges remain. The high tax rates and lack of deductions have drawn criticism from industry stakeholders, who argue that such measures could stifle innovation and drive activity to unregulated platforms. However, for small-town investors, the crypto dream is far from over. By understanding the nuances of the tax system and leveraging available exemptions, they continue to find ways to participate in this digital revolution.

As India’s crypto ecosystem matures, it is likely to see further policy refinements and legal developments. For now, stories like that of the Bengaluru techie serve as both inspiration and a blueprint for navigating the complex interplay of investments and taxes in the world of cryptocurrencies.

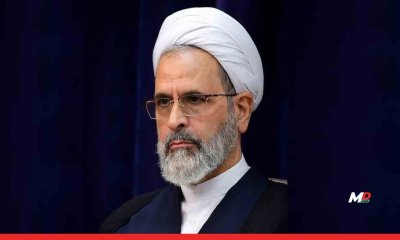

Who is Ayatollah Alireza Arafi, Iran’s interim Supreme leader?

What is ‘Temple’, Deepinder Goyal’s new Brain Wearable?

Escalating Israel-US-Iran conflict sees aviation network grounded

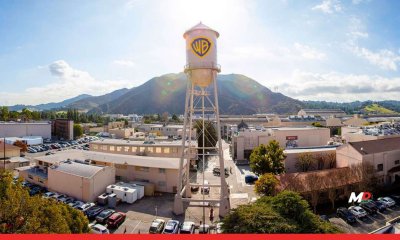

What does the Paramount-Warner Bros deal mean for the future of streaming

Renault India February Sales Jump 31%, Growth Streak Continues ahead of Duster Launch

Ayatollah Khamenei confirmed killed, as Tehran promises retribution