Published

2 years agoon

In the fast-paced world of startups, conflicts between investors and founders are not uncommon. Byju’s, the renowned Indian edtech giant, is currently embroiled in a contentious battle between key investors and its CEO, Byju Raveendran. The investors, who hold a combined stake of 30% in the company, are demanding a third-party audit of the company’s financials and the removal of Raveendran from his position, going so far as to approach the National Company Law Tribunal (NCLT) for his removal.

For the past two years, key investors in Byju’s, including Prosus, Peak XV, Chan Zuckerberg Initiative, General Atlantic, Sofina, and Sands Capital, have been demanding greater transparency and accountability from the company. They seek a third-party audit of the financials and the removal of Byju Raveendran as the CEO. The investors, who collectively own a 30% stake, are contemplating approaching the NCLT under the rules for shareholders’ rights protection.

Byju’s, on the other hand, has argued that the shareholders’ agreement does not grant the investors the authority to vote on the CEO or management changes. This contention further fuels the conflict between the investors and Raveendran. The company has recently received a commitment of $300 million in an ongoing rights issue, which could potentially influence the outcome of the dispute.

The primary concerns expressed by the investors center around several key issues. Firstly, they cite a lack of transparency in Byju’s day-to-day operations and the delay in sharing financial statements with shareholders. The investors also claim that they were not adequately informed about the Indian government’s actions against Byju’s and its founder. Additionally, corporate governance problems, which led to the resignation of board members, have raised red flags for the investors.

Byju’s investors have grown tired of the opacity surrounding the company’s operations. They highlight the delay in sharing financial statements with shareholders and the lack of information regarding the Indian government’s actions against Byju’s and its founder. This lack of transparency has created a sense of unease among the investors, who believe that they should have been kept apprised of these crucial developments.

Another major concern raised by the investors revolves around corporate governance challenges within Byju’s. The investors assert that these challenges have led to the resignation of key board members, including representatives from Peak XV, Chan Zuckerberg Initiative, and Prosus. The investors view this as a sign of a flawed governance structure within the company.

Byju’s is currently entangled in multiple legal battles with lenders and vendors in both the United States and India. The investors worry that these ongoing legal challenges could significantly impact the company’s future. Furthermore, the financial performance of Byju’s has come under scrutiny. The company’s total expenses nearly doubled in the past year, reaching INR 13,668 Crores (approximately $1 billion). Loss-making acquisitions, such as WhiteHat Jr, have weighed down the company’s bottom line.

To address their concerns about financial performance and transparency, the investors have demanded a third-party audit of Byju’s financials. However, Byju’s has rejected this demand, asserting that the company has already engaged a new auditor who is “interactive” and has answered all questions from shareholders.

Prosus, a global investment giant with a 9.6% stake in Byju’s, has demanded the ouster of Byju Raveendran before participating in the ongoing rights issue. Prosus has also raised questions about the valuation of the company in the rights issue compared to its previous valuation of $22 billion. If Prosus does not participate in the rights issue, it stands to lose the most among all key investors.

Peak XV Partners, formerly known as Sequoia Capital, holds a 7% stake in Byju’s and has called for the resolution of transparency and corporate governance challenges. The investors want increased transparency, resolution of governance issues, and an end to Raveendran’s overarching influence on the company.

The ongoing conflict between Byju’s investors and founder Byju Raveendran has significant implications for the future of the company. If the investors fail to secure majority votes (75%) at the extraordinary general meeting (EGM) to remove Raveendran, they may resort to legal recourse. Approaching the NCLT could be an option for the investors to safeguard their interests and potentially dissolve the company.

The investors now face a critical decision regarding Byju’s future. They can either let the rights issue proceed or take legal action at the NCLT. While the rights issue might result in a value erosion, it would at least provide the investors with something to hold onto. On the other hand, forcing the company to wind down would have disastrous consequences for everyone involved.

The rights issue serves as a means for Byju’s to stabilize its business and buy time. It allows the company to raise capital and provide working capital to survive the challenges it currently faces. After six months, Byju’s could potentially approach investors for another external round of funding at a reasonable valuation.

Leading investors and founders in the Indian startup ecosystem have initiated negotiations between Byju’s management and the disgruntled shareholders. The aim is to find a resolution that satisfies both parties and averts a major scale-down or dissolution of the company. The outcome of these negotiations could have far-reaching implications for the entire Indian tech industry.

The ongoing conflict between Byju’s investors and CEO Byju Raveendran has placed one of India’s biggest startups in a state of uncertainty. The investors’ demands for transparency, a third-party audit, and the removal of Raveendran reflect their concerns about the company’s governance and financial performance. The resolution of this dispute, whether through the EGM or potential legal recourse, will shape the future trajectory of Byju’s. As the battle for control unfolds, the implications for Byju’s, its investors, and the Indian startup ecosystem as a whole remain uncertain.

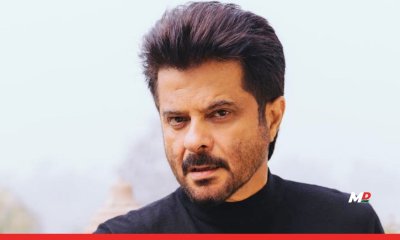

7 movies that made Anil Kapoor a Bollywood icon

OTT Watchlist: Choose from classics to romance and edge-of-your-seat thrillers

Geopolitical instability and interconnected risks raise fears of Black Swan scenarios

Lights, Camera, Action! Here are the biggest releases hitting theaters this March

Flipkart appoints Digbijay Mishra as new VP of Corporate Communications

Heavy hitting England face-off with India in Mumbai Semifinal