Business

Union Budget 2023: What you need to know

Published

3 years agoon

February takes on a different sense of importance for Indians everywhere, as the Union Budget starts to take precedence. Industry and society equally look to Union Finance Minister Nirmala Sitharaman in expectation as she presented the Union Budget 2023. This will be the last full-fledged Union Budget of the Modi government before the 2024 Lok Sabha elections, and everyone is expecting a windfall of some kind.

India remains a beacon of hope for the world economy, exhibiting growth even as a slowdown takes hold across the globe. Even so, addressing the Lok Sabha, the Finance Minister said that the government has lowered its growth estimates for the current fiscal year to 7% from earlier estimates of 8-8.5%. The estimates for the next fiscal year is 6- 6.8%, according to the annual economic survey report tabled in parliament on Tuesday.

Here are some of the major announcements from the Union Budget 2023 that caught the eye.

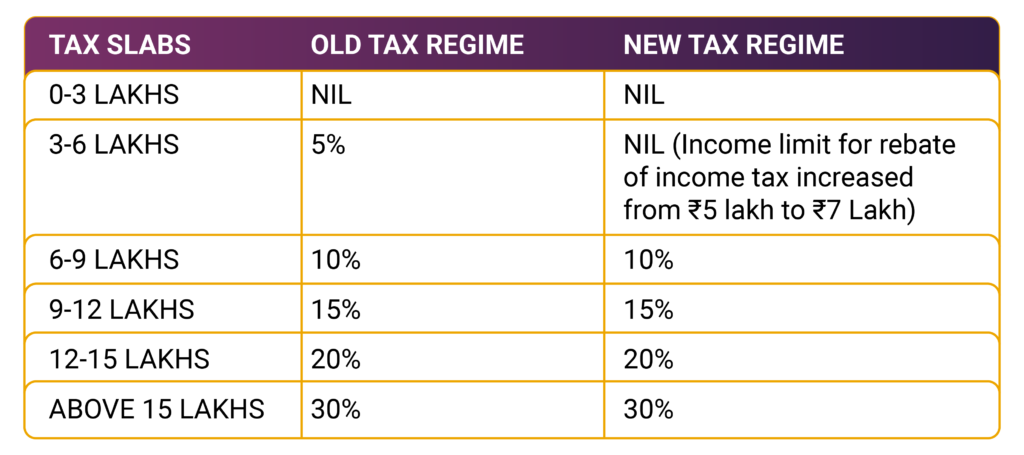

Increased tax rebate limit, from Rs. 5 lakhs to Rs. 7 lakhs

Revealed an updated provision of the new tax regime, Union Finance Minister Nirmala declared that the income tax rebate limit has been increased from Rs. 5 lakh to Rs. 7 lakh.

“I introduced in 2020, the new personal income tax regime with 6 income slabs, starting from Rs. 2.5 lakh. I propose to change the tax structure in this regime by reducing the number of slabs to 5 and increasing the tax exemption limit to Rs. 3 lakh”

– Union Finance Minister, Nirmala Sitharaman

The Budget has welcome news for smaller taxpayers, thanks to the increased rebates and higher exemption levels. Furthermore, the revision of tax slabs will ensure that the salaried class have something to cheer about in the year to come. Ultra HNIs too have much cause for celebration, as the highest surcharge rate has been reduced to 25% from 37%. However, those with income between Rs. 15 lakhs and Rs. 2 crores will continue to pay tax at 30%.

It is worth noting that the income tax slabs were not changed since 2014. The basic personal tax exemption limit was last revised in 2014.

New tax emption limit

Under the new tax regime, the basic exemption limit has been hiked to Rs. 3 lakh from the previous figure of Rs. 2.5 lakh.

Speaking in Parliament, the Finance Minister said, “I introduced in 2020, the new personal income tax regime with 6 income slabs, starting from Rs. 2.5 lakh. I propose to change the tax structure in this regime by reducing the number of slabs to 5 and increasing the tax exemption limit to Rs. 3 lakh.”

This is a welcome move that will help the salaried and middle class most.

New Income Tax regime to be default regime

While the new regime now becomes the default choice for taxpayers, the older tax regime can still be chosen if so desired. The focus on promoting the new regime is clear, whose basic exemption under this regime has increased to Rs. 3 lakhs from Rs. 2.5 lakhs.

Keep in mind that while the old tax regime allows PPF, NPS and some other concessions, the new regime will get the benefits of the increased standard deduction. So those above the Rs. 7 lakh annual income threshold will have to choose wisely between either tax regimes.

Annual income of Rs. 9 lakhs? Pay only Rs. 45,000 as tax

Under the new tax regime, a standard deduction of Rs. 45,000 has now been rolled out for salaried class and pensioners. Thus, an individual with Rs. 9 lakh annual income will now pay Rs. 45,000 tax, which is 5% of the salary. This represents a reduction of Rs. 15,000 from the present figure of Rs. 60,000.

Conversely, a person with Rs. 15 lakh annual income will have to pay a tax of Rs. 1.5 lakh, a reduction from the previous figure of Rs. 1.87 lakh.

The Finance Minister went on to announce that the average processing time for income tax returns has been reduced from 93 days to 16 days.

Here are some of the other key announcements of Budget 2023:

- Budget adopts seven priorities including inclusive, green growth, reaching the last mile, infra & investment, unleashing the potential, Youth power and financial sector 50-year interest free loan to State governments extended for one more year

- Digital public infrastructure for agriculture to be built

- Outlay for PM Awas Yojana is being enhanced by 66% to over Rs 79,000 crore

- Capital outlay of Rs 2.40 lakh crore has been provided for the Railways, which is the highest ever and about nine times the outlay made in 2013-14

- Investment of Rs 75,000 crore, including Rs 15,000 crore from private sources, for 100 critical transport infrastructure projects, for last and first mile connectivity for ports, coal, steel, fertilizer, and food grains sectors

- 30 Skill India International Centres to be set up across different states to skill youth for international opportunities

- Agricultural credit target raised to Rs. 20 trillion ($244.42 billion) for 2023/24

- Revamped credit guarantee scheme for MSMEs to take effect from 1st April 2023 through infusion of Rs 9,000 crore in the corpus. This scheme would enable additional collateral-free guaranteed credit of Rs 2 lakh crore and also reduce the cost of the credit by about 1%

- The maximum deposit limit for Senior Citizen Savings Scheme to be enhanced from Rs 15 lakh to Rs 30 lakh

- To commemorate Azadi Ka Amrit Mahotsav, a one-time new small savings scheme, Mahila Samman Savings Certificate, to be launched. It will offer deposit facility of up to Rs 2 lakh in the name of women or girls for tenure of 2 years (up to March 2025) at fixed interest rate of 7.5 per cent with partial withdrawal option

- Facilities in select ICMR labs will be made available for research by public and private medical faculties

- Capital investment outlay being increased by 33% to Rs. 10 lakh crores, which would be 3.3% of GDP

- National Data Governance Policy to be brought out to unleash innovation and research by start-ups and academia

- National digital library for children and adolescents will be set up for facilitating quality books

- Govt plans to set up massive decentralised storage capacity to help farmers

- National cooperative database is being created to map cooperative societies

- The outlay for PM Awaas Yojana being enhanced by 66% to over Rs 79,000 crores

- 38,800 teachers will be hired for Ekalavya Model Residential Schools

- Govt to provide Rs. 5,300 crore assistance to drought-prone central region of Karnataka

- Rs. 2.40 lakh crore boost for the Indian Railways, increasing the budgetary allocation for the sector

- Govt to bring National Data Governance policy

- PAN will be used for common identifier for all digital systems of specified government agencies

- Phase-III of e-courts will be launched

- Customs duty on lab grown diamonds to be reduced

- Govt targeting 5 MT of Green Hydrogen production by 2030

- Govt to spend Rs. 10,000 crore per year for urban infra development fund

- Green credit programme will be notified under the Environment Protection Act

- Govt to take up mangrove plantation along the coastline under the new MISHTI scheme

- FY-2024 fiscal deficit target at 5.9% of GDP

- Fiscal Deficit targeted to be below 4.5 per cent by 2025-26

- Govt to facilitate 1 crore farmers to adopt natural farming

Industry Perspectives

“The Union Budget highlights the government’s focus on Care, Green, and Digital – three crucial themes that will continue to shape our economy. The good push on specialized education in nursing and medical devices, as well as the strengthening of teacher training, will help build a strong foundation for our healthcare system. The promotion of online learning through Mission Karmayogi and the IGOT platform will further drive the adoption of digital technologies, even across rural and remote regions.

Another significant milestone includes the focus on setting up more AI and 5G labs and R&D centres and the need for a skilled talent pool to support this adoption, which will drive the digital transformation of our economy.

“We are happy with the announcement of new dedicated multi-disciplinary courses for the medtech industry in the Union Budget 2023–24. Medical devices, especially equipment for cancer treatment, need to be operated with the utmost care and precision. It is important for clinicians to be upskilled periodically to effectively operate high-tech precision medical devices. The specific focus on skill development through PPP models for healthcare is a welcome change and a step in the direction of progress. This will help in building better cancer care infrastructure in totality by pushing access and availability across the country.”

CEO, BCT Digital

“The budget was an excellent opportunity for the Finance Minister to take advantage of India’s pole position globally, and she has done justice to it. With finances bolstered by recent oil gains related to events across Europe and clean PSB balance sheets, the government had decided to spend on infrastructure in a big way, while still maintaining the controlled fiscal deficit path. The focus on refining the banking and financial markets through technology-led initiatives, such as the National Financial Information Registry and unified KYC; replacing the tedious process of document submission with DigiLocker storage; result-based financing, and reforms to develop the municipal bond market will pave the way for the maturity of our markets to global benchmarks.

By recognizing Green growth as an important pillar in the budget, the FM has laid the path towards economic development that is sustainable and in line with global efforts to tackle climate change. Green growth includes initiatives such as the promotion of renewable energy sources and the adoption of more sustainable practices, which in turn will promote broader Environmental, Social, and Governance (ESG) initiatives by companies.

On the other hand, the rationalization of tax slabs, simplification of compliances for small businesses, and most importantly, the reduction in personal income taxes would put more money in the hands of the public, thereby boosting the economy after the pandemic-induced slowdown over the last couple of years.”

“Budget 2023-24 focused on enhancing India’s capabilities and resources through increased manpower, R&D, and PPP in healthcare sector. Setting up of 157 new Nursing colleges is welcome, in view of the severe shortage of nurses in the country. However the current state of existing Nursing colleges must .be evaluated for upgradation & better job opportunity for nurses to be identified to curb international migration

The idea of setting up a Center of Excellence in AI for health along with the strengthened impetus towards medical education will accelerate the development of new-age, technology-driven medical solutions for better disease management and encourage start-ups to come up with Innovative solutions in the Healthcare Delivery space.

Creating awareness of prevention and early screening is not only essential in eliminating sickle cell anaemia but would also be a great stepping stone for similar diseases, however its success will depend on effective implementation.

The increased focus on encouraging medical education and PPP will aid the industry’s growth. The budgeted increase in healthcare expenditure of 15% does not seem to have enough to tide over the current challenges of upgradation of infrastructure and providing accessibility and affordability for quality healthcare in the country.

We are looking forward to clear indications of the steps to be implemented for healthcare infrastructure development and move closer towards universal health coverage with increased expenditure as a % of GDP. It would have been better if there were tax exemptions for healthcare, which is vital to reduce healthcare expenses & out of the pocket spending.”

“The Union Budget 2023’s focus on research and development directed towards innovation to support investment by the industry is a welcome move. As the pharmacy to the world, the push towards innovation and research will further our goal to deliver quality care to all. Increasing the number of labs at ICMR facilities through public-private partnerships is encouraging to ensure a holistic research environment in India.

Additionally, the government’s attention to the vision of ‘Make AI in India’ and ‘Make AI Work for India’ and the setting up of three Centers of Excellence for Artificial Intelligence in top educational institutions, a push towards Unified Skill India Digital platform will aid in increasing industry-academia collaboration.

The allocation in Union Budget 2023-24 allows the industry to collaborate in conducting interdisciplinary research, and develop innovative applications and scalable problem solutions in the areas of health. Thus, the announcement holds the potential to increase focus on research for new chemical entities, and drugs for rare diseases in India.”

“The Budget 2023 saw the Government lay its focus on skilling of youth – students and salaried professionals, which resonates heavily with the work that the edtech sector is doing. The Budget specified that there will be courses provided in areas like AI, IoT, Robotics, and other soft skills, to steer the youth towards meeting the demands of today. At Jaro Education, we have also been striving to provide courses to our consumers around these new-age requirements. The Government encouraging the same goes a long way in putting it under the spotlight. The Pradhan Mantri Kaushal Vikas Yojana 4.0 is now being united with the needs of Industry 4.0 to align education courses that meet the needs of the industry.

The Edtech industry was hoping for support from the Government in the form of schemes and incentives for improving online initiatives. We hope the Government revisits GST on education, especially higher education and upskilling courses. The current GST on education services is 18%, which is for luxury items. In the current industry dynamics, such education is not luxury but essential and hence, we hope for consideration on the same.”

“The government’s announcement of launching multidisciplinary centres for medical device shows the progressive thinking and commitment towards improvement of healthcare sector.

They recognize the fundamental interdisciplinary nature of medical devices by encouraging collaboration between hardware and software engineers, physicians, and clinicians, which will pave the way for the development of novel and efficient solutions.”

The Union Budget FY23-24 is an extremely progressive and inclusive one with a huge focus on infrastructure and capex growth while maintaining the fiscal consolidation path. With fiscal deficit being reduced to 5.9% whilst providing an extremely bullish capex investment of Rs. 10 lac crores (highest ever in the last 12 years); will in effect convert revenue expenditure to capital expenditure which has a higher multiplier effect.

It will also mean net borrowing by the Govt being lower than anticipated at Rs. 11.8 lac crores and that augurs well for the bond market and the corporate sector as a whole. Moreover, with tax relief at an individual level would mean at an additional Rs. 35,000 crores available for consumption. Fuelled by ease of doing business related policies and regulations, this will bolster growth, especially in the highly regulated financial services space. For a category like general insurance, these macro-economic indicators would provide the much-needed thrust for bridging the penetration gap in the country.

There are some pertinent developments that will enable growth for the industry in the longer horizon. The focus on tourism will pave the way for not just generating employment and investments, but also travel insurance in the long term. We have always been zealot about capacity and capability building in health arena and Govt setting up nursing colleges is a positive development.

In fact, I believe the CoE on AI being set up could be a game changer with access to the right talent pool in India. On the auto front, the old vehicle and ambulance scrapping policy is a step in the right direction. Overall, the budget this year has been growth oriented while also being fiscally responsible, which is laudable.

In one word, the FY24 Union Budget could be characterised as fiscally prudent. It continued on the path of fiscal consolidation at a time when India’s current account deficit is elevated and global central banks are tightening. The finance minister, reiterated her commitment to the glide-path of reducing fiscal deficit to 4.5% of GDP or below by FY26. All this goes a long way in ensuring India’s policy credibility.

What makes it more commendable is that 2023 happens to be a pre-election year and this was the last full-fledged Budget of this term of the government and yet, the policymakers resisted the temptation of fiscal profligacy. If anything, the spending boost is very much capex-oriented. The Budget is projecting a whopping 37% growth in capital spending over and above similar growth achieved in FY23. In fact, FY24 capex is likely to be 3x of the pre-pandemic levels.

Even if we include the capex spend expected from PSUs, the total capex spend is still expected to grow 25%. Further, government’s focus on capex is not just limited to spending push but also policy-push especially the PLI scheme, which is generating a lot of interest among businesses. All this will work to crowd-in the private capex. Already, the order book growth rate of industrial companies are seeing a good traction over the last few quarters and this is likely to accelerate in the coming years. The income tax structure has been further rationalised and leave more income into the hands of the consumers, which should help broaden the consumption recovery in urban centres. All told, the Union Budget 2023 covers a lot of ground in securing macroeconomic stability while ensuring a right-kind of push to economic growth.

The thrust on infrastructure, energy transition, green hydrogen and Make in India are the key growth areas highlighted in this budget. For the nation to move towards a 5 trillion economy; creation of roads, ports, airports and railway infrastructure is paramount.

Green energy thrust shall reduce dependence on imports of fossil fuel and create an enabling environment for a cleaner future. Energy in transition and net zero is the way to go if we have to create a sustainable business environment for future generations.

The direct tax policies share spur consumption and increase the size of the economy as disposable income increases, and this shall have a multiplier effect for the GDP growth.

Creation and funding of labs for startups is the much-needed creation of innovation infrastructure as India moves higher on the innovation index.

The overall budget is a force multiplier and is positive to take our country to a more advanced and inclusive nation.

The Union Budget is a testament to the government’s vision of achieving a technology-driven and knowledge-based economy, with strong public finances.

The government’s focus on capital allocation is a clear indicator of its intention of bolstering growth and employment in the country. We believe the increment in capital investment outlay for the third year in a row by 33 per cent to Rs 10 lakh crore will lead to a virtuous economic cycle of private sector capex, job creation and growth. Towards inclusive growth, the FM has made healthy budgetary provisions Agriculture and cooperatives, Health, Education and Skill development. And inspite of these increased spends, it is encouraging to see FY24 fiscal deficit target at 5.9% vs 6.4% for FY23, indicating high level of fiscal prudence.

The new proposed income tax regime, effectively puts Rs 35,000 crore in the hands of the taxpayers, providing higher disposable income in their hands. This will enable them to not just consume more products and services, but also open more investment avenues. Further, the government’s decision of allowing SEBI to develop, maintain and implement norms and standards for education in the National Institute of Securities Markets (NISM) will enhance the competencies of functionaries and professionals in the securities market.

Mindful of its environmental commitment, various Green Growth have been initiatives unveiled which will additionally provide employment opportunities.

You may like

-

Ayatollah Khamenei confirmed killed, as Tehran promises retribution

-

USA and Israel attack Iran, plunging Middle East into chaos

-

Union Budget 2026: The verdict from the Boardroom is in

-

Union Budget 2026: All the key announcements made by the FM

-

Maharashtra Deputy Chief Minister Ajit Pawar passes away after plane crash near Baramati

-

Deepinder Goyal resigns as Eternal CEO; Blinkit’s Albinder Dhindsa to take the helm