Published

3 years agoon

It’s 2023 finally, and the time of the year when the tone for many of our life’s activities has been set. Monthly bills, basic requirements, and unexpected expenses will continue to pile up, and you don’t want to be caught off guard. With inflation on the rise, it’s only prudent to start the New Year on a solid financial footing.

Many people deal with finances without understanding the science behind them. Competitive nature and lack of self-discipline have been the key financial setbacks, stating that with appropriate planning and adequate financial literacy, one would be financially stable.

As we all know, new year’s resolutions are easy to make but harder to follow, so here we have curated 5 healthy finance habits that you can follow to make sure you are designing a foundation for your financial success in 2023.

Make more than your minimum debt payments

When you have debt, it can be tempting to simply make the minimum monthly payment. That way, you’ll have extra money to spend on other things each month. The issue is that you end up paying significantly more money in the long term. Paying off your debt quickly could save you hundreds, thousands, or even tens of thousands by way of interest, depending on the amount of debt you have. The sooner you pay off your debt, the sooner you’ll have money in your budget to put somewhere else. Remember that having debt has other consequences. Assume you want to buy a house. A lender is unlikely to approve you for a mortgage if you have too much debt.

Separate savings from investments

Adopt the technique of investing large sums of money that come in on occasion as well as little amounts regularly. Your small investments in government bonds, mutual funds, and so on can add up to a lot of money in the long term. Seek insider information to make the best investment decisions. It will provide you with a competitive advantage.

Some investments can be risk-free, but others could be more volatile. In general, younger people should invest more aggressively, and older ones should invest more conservatively. If you’re a new investor, start with a basket of investments, such as a mutual fund or assets you select. The goal should be to diversify without overcomplicating or narrowing your portfolio. If you wish to increase your savings and investments, you just have to follow a simple formula- scale up your income and reduce your consumption. Your investing approach should be based on criteria such as your time horizon, risk tolerance, and personal financial status, whether you are a newbie or a seasoned investor.

Maintain an emergency fund

The last few years have taught everyone the value of keeping an emergency fund. With millions of people losing their jobs, the last few years have caused massive medical expenditures for many families. Even if your finances were unaffected by the pandemic, chances are you’ve encountered a financial emergency that you struggled to pay in the past. If you’re just starting out and have a high-interest debt to pay off, such as credit cards, you must try accumulating at least one month’s worth of spending in your emergency fund. You can eventually work your way up to 3-6 months. When you utilise your emergency money, make sure to replenish it.

Schedule frequent financial discussion dates and improve your financial literacy

It is critical to keep track of, update, and document your finances. Keeping a regular money date with yourself is an excellent strategy to keep track of your funds. Put it on your calendar so you don’t forget. You can also share your financial choices with your trusted family member on a monthly basis, what you spent the previous month, what important occasions are coming up in the upcoming month, and any adjustments you are thinking about making to your budget or finances.

The more financially educated a person is, the better money judgements they make and the less likely they are to fall for scams, make mistakes, or miss out on good possibilities. There are numerous tools accessible, such as free internet resources and training, or one can pay to consult with an expert and achieve significant gains. Hiring a mentor for any business endeavour, attending seminars, and learning from the mistakes of others could save you a lot of money. Gaining financial literacy can help one understand the types of financial transactions to engage in, the types of credits to take, the charges, and whether one has the capacity to service incurred credits in order to prevent a crisis.

Recognize and Manage Lifestyle Inflation

Most people will spend more money if they have more money. As people advance in their jobs and earn better salaries, they tend to spend more, a phenomenon known as lifestyle inflation. Even if you can pay your payments, lifestyle inflation can be detrimental in the long run since it inhibits your potential to accumulate wealth. Every penny you spend now equals less money later and during retirement and having more disposable income today does not ensure having more money afterwards. Some increases in spending are natural as your career and personal circumstances evolve over time. As you progress through life, re-evaluate your personal budget to ensure that it reflects the proper conditions in your life. When creating a list of your expenses, consider which costs are genuinely necessary and which might be eliminated.

It is always stated that it is never too late to begin saving for retirement. That is technically correct, but the sooner you begin, the better off you will be in your retirement years. This is due to the compounding effect. Compounding is the reinvestment of money, and it works best over time. The longer earnings are reinvested, the bigger the value of the investment and the larger earnings will be.

Whether you’re a young adult looking to start saving for retirement, a 40-something looking to pay off your mortgage, or an elderly person living on a fixed income, these suggestions can help you grow savings, reduce debt, increase income, and invest properly.

India’s ₹10,000 Cr Startup Push: Fueling Innovation, One Venture at a Time

Government to Soon Launch Portal to Track Every New Home in Maharashtra

Celebrating the Joy of Parenthood: Need for Innovation & Awareness on fertility care

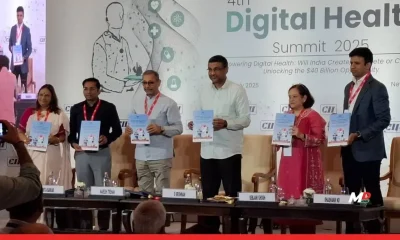

Wellness is No Longer a Cost, Its Capital: CII–MediBuddy Report Maps Corporate India’s Digital Health Readiness

Mphasis Invests in Aokah to accelerate AI-driven transformation for global operations and capability centers

Seven Must-Watch OTT Picks Lighting Up Your Weekend